Why equipment depreciation matters more... a lot more than you think.

Let us explain.

In asset-heavy operations, equipment depreciation isn’t just a tax concept—it’s a hidden cost that quietly erodes budgets, disrupts planning, and impacts decision-making across the board.

Every asset loses value over time, but treating depreciation as a year-end accounting task means missing critical insights. It affects everything from maintenance schedules and insurance coverage to replacement timing and capital planning.

Let's explore the real impact of depreciation—how it shapes financial outcomes, where hidden costs hide, and how better visibility can help you extend asset life and reclaim lost value, in the next 5 minutes.

What is equipment depreciation?

At its core, equipment depreciation is the gradual loss of value that occurs as assets age, are used, or become outdated. It’s a common concept in accounting, but its implications go far beyond financial reporting.

When a company purchases a piece of equipment—say, a commercial HVAC unit or a floor scrubber—it begins losing value the moment it’s put into service.

This loss can be driven by wear and tear, reduced efficiency, outdated technology, or even changes in safety regulations.

Real-life example: How depreciation affects more than just accounting

Let’s say your facilities team installs a $50,000 commercial HVAC unit in a mid-sized retail property.

📉 On paper: The unit is depreciated evenly over 10 years, losing around $5,000 in book value each year.

But here's what often happens behind the scenes:

- 🛠️ Year 1–3: The unit runs efficiently with minimal upkeep. Everything seems fine.

- 🌡️ Year 4–6: Usage increases during peak seasons. Preventive maintenance is missed.

- ⚡ Energy use spikes by 30%, and breakdowns become more frequent.

- 🚫 Year 6: Though the unit still has $20,000 book value, it:

- Requires emergency repairs often

- Fails to meet updated refrigerant regulations

- Is less energy-efficient than newer models

📊 This misalignment creates hidden costs, like higher utility bills, compliance risks, and potential unplanned replacement, all while your balance sheet still shows the asset as valuable.

Why equipment depreciation is more important than most teams realize

Understanding equipment depreciation isn’t just useful but essential for smarter financial planning, operational reliability, and long-term strategy.

Here’s why:

1. It drives smarter repair vs. replace decisions

Depreciation trends reveal when an asset is nearing the point of diminishing returns. If a high-depreciation asset (like older HVAC units or cleaning equipment) starts demanding frequent repairs, you’ll know it’s time to retire it before costs spiral.

Conversely, assets with slower depreciation—such as steel shelving or industrial boilers—can be safely extended, optimizing ROI.

2. It shapes your financial reporting and tax liability

Depreciation isn’t just an operational concern—it’s a core accounting principle. It’s recorded as an expense on your income statement, lowering your taxable income and affecting net profit. Miscalculating or overlooking depreciation can skew your financials, potentially misleading stakeholders like investors, auditors, or lenders.

3. It strengthens capital planning and budget forecasting

Tracking depreciation helps you anticipate when replacements will be needed, and what they’ll cost. With this visibility, you can schedule replacements during off-peak seasons, apply for capital in advance, and avoid emergency purchases that blow through budgets.

How is equipment depreciation calculated?

There’s no one-size-fits-all approach to calculating depreciation. The method you choose can significantly affect your books, budgets, and asset strategies.

Here’s a breakdown of the most common methods—and when they make sense to use.

1️⃣ Straight-line depreciation: The simplest and most common

📌 Best for: Office equipment, lighting systems, and assets with steady usage over time

Example:

- Cost: $10,000

- Salvage value: $2,000

- Useful life: 5 years

- Annual depreciation: ($10,000 – $2,000) ÷ 5 = $1,600/year

Pro: Predictable, easy to apply

Con: Doesn’t reflect real wear, usage spikes, or maintenance impact

2️⃣ Declining balance method: Front-loaded depreciation

📌 Best for: High-tech equipment or tools that lose value quickly in the early years

This method applies a fixed percentage to the book value each year, resulting in higher depreciation upfront.

Steps:

- Choose a depreciation rate (e.g., double the straight-line rate = 40%)

- Multiply it by the current book value

- Subtract to get the new book value, and repeat yearly

Pro: Great for assets that rapidly lose efficiency

Con: Complex for long-term forecasting

3️⃣ Sum-of-the-years’-digits (SYD): Weighted toward early use

📌 Best for: Assets with steep performance drop-off in early years (e.g., IT equipment)

SYD assigns more depreciation to early years using a weighted formula.

Example for a 5-year asset:

- Sum of years: 5+4+3+2+1 = 15

- Year 1 depreciation = 5/15 × asset cost

- Year 2 = 4/15 × cost … and so on

Pro: Mimics how many assets lose value

Con: Requires upfront planning of the entire schedule

4️⃣ Units of production method (UOP): Usage-based

📌 Best for: Vehicles, compressors, chillers, or anything with quantifiable output

Rather than time, this method uses output or usage hours to calculate depreciation.

Steps:

- Estimate total units of production

- Depreciation per unit = (Cost – Salvage Value) ÷ Total Units

- Multiply by the actual units used in a period

Example: If a generator is expected to run 10,000 hours, and it runs 1,000 hours in a year → Depreciation = 10% of depreciable cost for that year

Pro: Most accurate for variable-use assets

Con: Requires detailed tracking of usage data

How do different depreciation methods impact asset value over time?

Depreciation methods aren’t one-size-fits-all.

This chart illustrates how various approaches affect asset value over time—and why the method you select is crucial.

to choose the right method: when to use which method of calculation

Not sure which depreciation method fits your assets best?

This table helps match each method to its ideal use case and depreciation pattern.

Is equipment depreciation a reliable metric?

✅ Yes—for financial reporting.

❌ Not always—for real-world asset health.

Depreciation is a critical accounting tool, but relying on it as your only indicator of an asset’s value can lead to blind spots.

From a financial standpoint, it’s a standardized way to:

- Spread asset costs across useful life

- Reduce taxable income

- Inform balance sheets and capital audits

But here’s where things get tricky: depreciation doesn’t account for actual usage, performance drops, or maintenance history.

🚧 Example blind spots:

- A forklift might be fully depreciated after 7 years, but still running at 80% efficiency with regular upkeep.

- A data center UPS system might still have book value, but suffer frequent failures due to thermal stress, costing more to maintain than replace.

Depreciation is also a non-cash expense, which means it doesn’t directly move money in or out of your business, but it influences cash flow decisions indirectly:

- A high depreciation expense can reduce taxes (positive cash impact)

- Fully depreciated assets may increase repair costs and insurance premiums (negative impact )

Depreciation is reliable within its context. Use it to track financial aging, but always pair it with real-time asset data, usage tracking, and performance-based insights for operational decision-making.

How to go beyond depreciation: A holistic approach to asset value

Depreciation gives you a starting point, but it doesn’t tell the whole story.

To manage equipment more effectively and ‘profitably’, you need a broader view that integrates financial, operational, and strategic performance.

Here’s how to take a more holistic approach:

1. Include financial performance metrics

While depreciation shows how an asset’s value declines over time, metrics like ROI, IRR, and NPV help you assess whether that asset is still worth keeping.

- ROI shows if the equipment continues to deliver value relative to its cost

- IRR helps compare investment efficiency across asset types

- NPV calculates the asset’s long-term financial impact, accounting for future costs and benefits

Example: A forklift that’s fully depreciated may still generate excellent ROI if it's maintained well and enables faster operations on the warehouse floor.

2. Evaluate Total Cost of Ownership (TCO)

TCO goes beyond purchase price to include all lifecycle costs—maintenance, repairs, energy use, and eventual disposal or replacement. It tells you what the asset truly costs to own and operate.

Example: A less expensive HVAC unit may end up costing more over time due to higher energy bills and frequent part replacements.

3. Incorporate real-world performance data

To make accurate decisions, you also need to track how the asset performs in the field. This includes:

- Usage data and runtime

- Maintenance frequency and repair history

- Condition assessments and efficiency metrics

These insights help identify hidden costs and flag underperforming assets, long before the depreciation schedule catches up.

Final takeaway: Don’t stop at depreciation

Depreciation should be treated as one piece of the puzzle, not the full picture. By combining it with strategic metrics, TCO analysis, and operational insights, businesses can:

- Improve replacement timing

- Prioritize investments

- Maximize asset value throughout the lifecycle

That’s the shift from reactive accounting to proactive asset strategy.

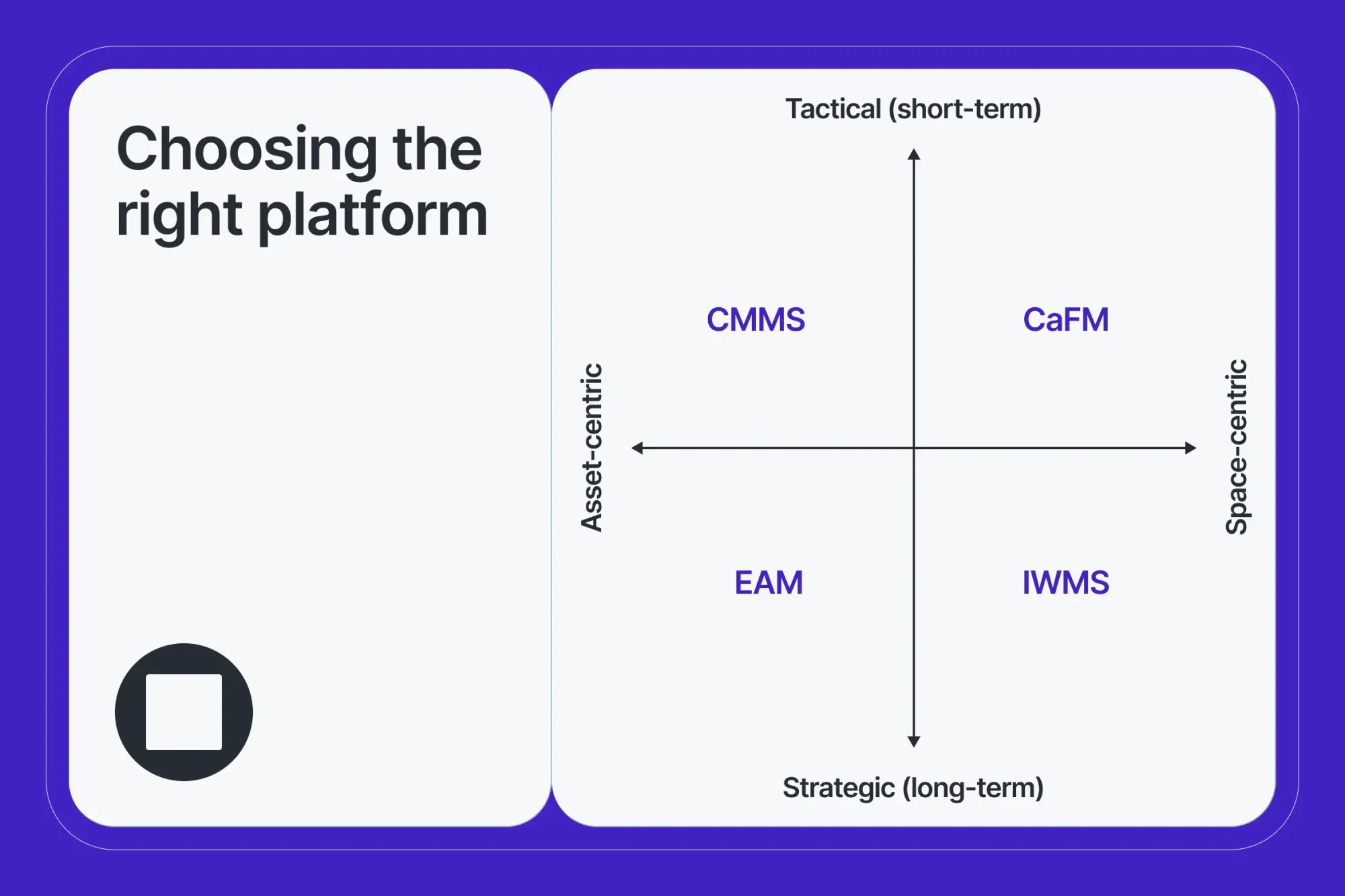

Turn depreciation into a lever for operational efficiency—with a Connected CMMS

For senior leaders overseeing complex facilities or asset portfolios, depreciation isn’t just an accounting term—it’s a daily reality that shapes capital planning, risk exposure, and long-term operational costs.

Yet most teams only track depreciation retroactively, using static schedules that don’t reflect real-world asset performance.

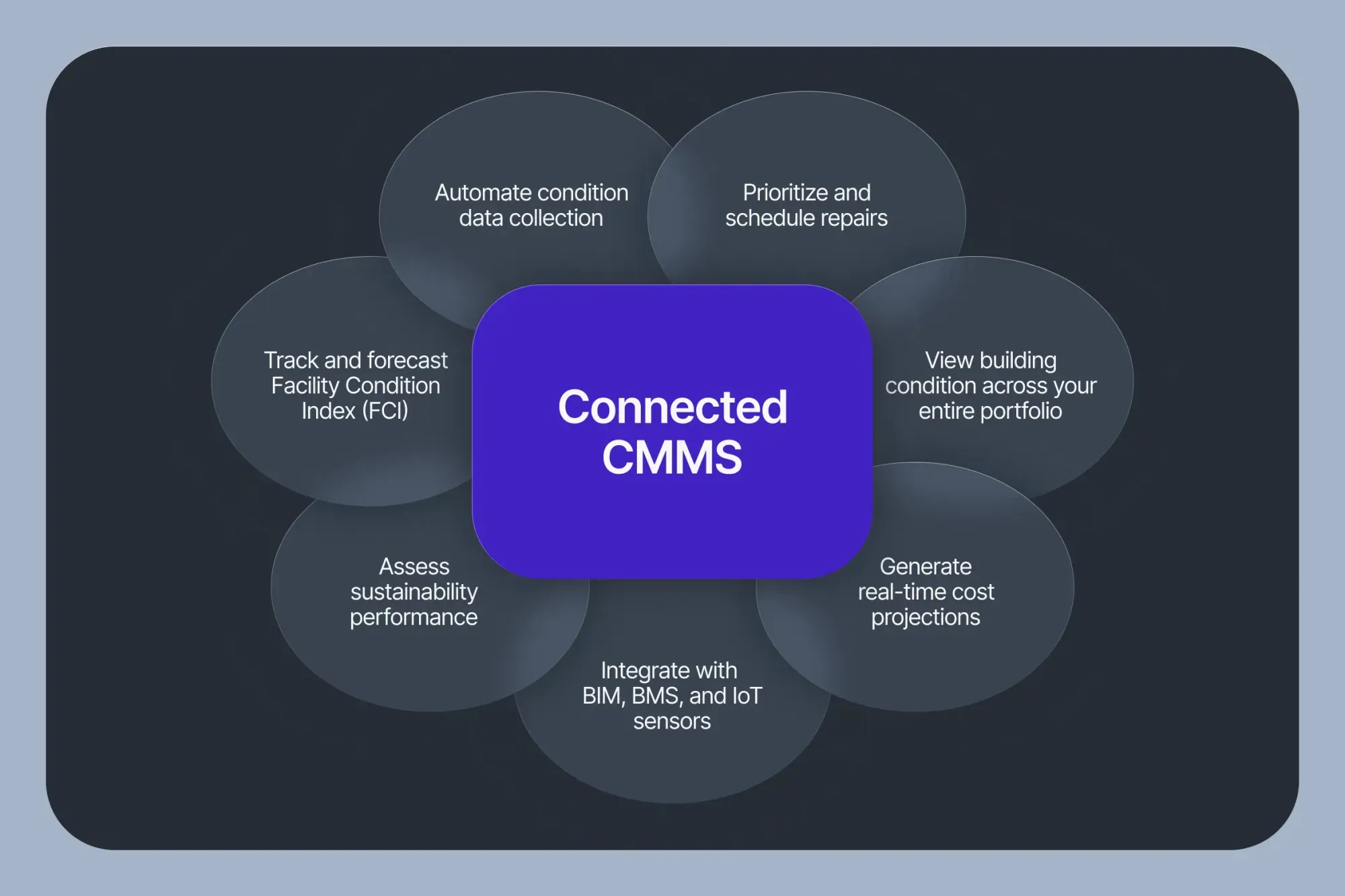

A Connected CMMS software like Facilio changes that.

Facilio centralizes asset data, condition monitoring, and maintenance execution in one platform. It gives you real-time visibility into asset health, usage, and lifecycle value—the very factors that influence how, when, and why your assets lose value.

Here’s how it helps you move from reactive depreciation tracking to strategic lifecycle control:

- Accurate, usage-based depreciation insights powered by live asset data

- Automated preventive maintenance that slows depreciation by reducing wear and failure

- Centralized asset lifecycle management, from acquisition to retirement

- Condition-triggered workflows that align maintenance and capital planning

- Real-time dashboards for visibility into asset aging, performance, and cost centers

With Facilio, you don’t just track depreciation—you minimize it by keeping assets running optimally, extending useful life, and timing replacements based on evidence, not estimates.

The result?Stronger financial forecasting. Lower lifecycle costs. Better capital efficiency. And a maintenance strategy that actively protects your bottom line.

Ready to take control of asset value and lifecycle costs?

Discover how Facilio’s Connected CMMS turns depreciation into a strategic advantage.

Frequently asked questions on equipment depreciation

✅ 1. Is equipment depreciated over 5 or 7 years?

Most equipment is classified as five-year property under the Modified Accelerated Cost Recovery System (MACRS). This includes assets like computers, office equipment, vehicles, and construction tools. Some categories, like office furniture and appliances, fall under the seven-year category.

✅ 2. How do you calculate the depreciation of equipment?

Depreciation is typically calculated using this formula:

Annual Depreciation = (Acquisition Cost − Residual Value) ÷ Useful Life (in years)

This spreads the equipment’s cost over its estimated useful lifespan, helping organizations forecast expenses and manage capital planning.

✅ 3. What is the useful life of facility equipment?

The useful life varies by asset type. For example:

- HVAC systems: 15–20 years

- Generators: 10–15 years

- Elevators: 20–30 years

Manufacturers, industry standards, and IRS guidelines typically define useful life.

✅ 4. Can CMMS software track equipment depreciation?

Yes. Modern Connected CMMS platforms allow you to track acquisition costs, usage hours, warranty status, and maintenance history—helping forecast depreciation and plan replacements more strategically.

✅ 5. Why is calculating equipment depreciation important in FM?

It helps to:

- Make informed capital planning decisions

- Justify equipment replacement budgets

- Reduce lifecycle costs

- Improve asset investment returns

Depreciation also ties into compliance and audit readiness for many FM organizations.