14 Best ESG Reporting Software: Features, Platforms, and How to Choose

The business landscape is shifting as environmental, social, and governance (ESG) reporting becomes a priority. With new regulations, investor scrutiny, and global net-zero targets, companies can no longer rely on manual processes.

From frameworks like SASB to the SEC’s proposed rules on greenhouse gas (GHG) disclosures, compliance is now mandatory, and failure comes at a cost. Beyond avoiding penalties, proper ESG reporting builds transparency, manages risks, and strengthens brand reputation.

This is exactly where ESG reporting software plays a critical role.

These platforms simplify compliance, improve data accuracy, and help businesses track progress toward sustainability goals.

In this guide, we’ll explore what ESG software is, the features that define the best platforms, and how to choose the right solution—including how Facilio helps enterprises streamline ESG reporting.

ESG reporting is the disclosure of a company’s environmental, social, and governance performance against defined benchmarks and targets. It gives stakeholders and investors the transparency to assess long-term value and risks.

For instance, Amazon’s sustainability report details its goal to reach net-zero carbon emissions by 2040 and its recent 0.4% reduction in absolute emissions. Done well, ESG reporting ensures compliance, builds trust, and drives sustainable business growth.

Why are ESG reporting tools becoming so important?

The pressure on businesses to report ESG performance has never been greater. Here’s why:

- Stricter regulations: From the SEC’s climate disclosure rules to the EU’s Corporate Sustainability Reporting Directive (CSRD), companies are now required to publish accurate, auditable ESG data. Non-compliance can result in heavy fines and reputational damage.

- Investor expectations: ESG factors are increasingly used to assess long-term business value and risk. A strong ESG record can improve access to capital.

- Customer demand: Modern consumers prefer brands that operate responsibly, making ESG performance a factor in loyalty and brand reputation.

The challenge?

Manual reporting methods—like spreadsheets—often lead to fragmented data, errors, and inefficiencies.

That’s why ESG reporting tools are becoming indispensable. They help organizations:

- Centralize and standardize ESG data.

- Automate reporting across frameworks like GRI, SASB, and CSRD.

- Generate real-time insights for decision-making.

- Track emissions, energy use, and sustainability metrics at scale—especially critical for industries like real estate and facilities management.

In short, ESG tools are no longer optional add-ons; they’re now essential for compliance, transparency, and building business resilience.

Key features of the best ESG reporting software

The best ESG reporting software goes beyond compliance—it equips organizations to monitor, manage, and improve sustainability performance in real time.

Here are the features that matter most:

- Centralized data collection

- Brings together ESG data from across your operations—facilities, supply chain, and business systems—into one platform.

- Eliminates silos and ensures accuracy across all disclosures.

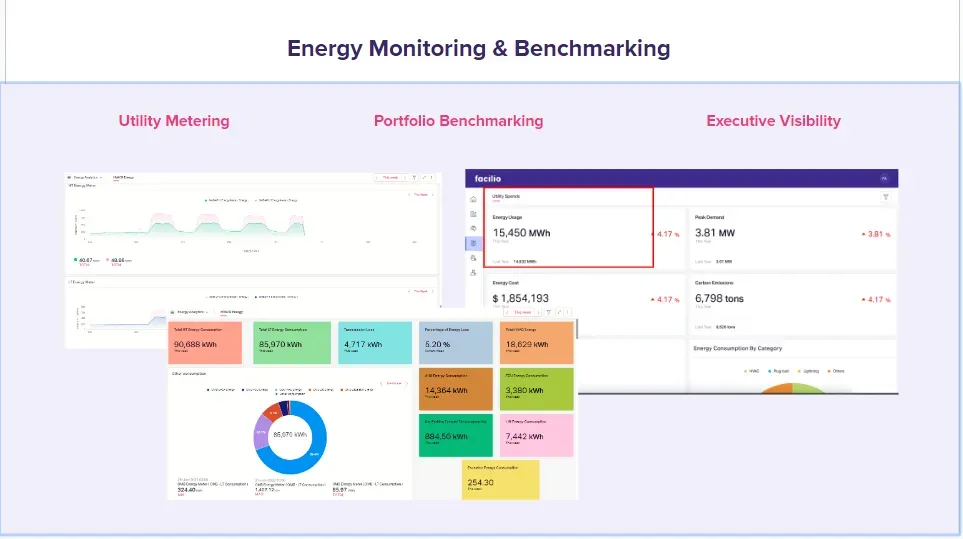

- Energy monitoring & benchmarking

- Tracks and analyzes energy use to spot inefficiencies and optimize consumption.

- Benchmark performance internally (against past usage) and externally (against peers and industry standards).

- Facilio, for instance, provides real-time KPIs and role-based reports to help teams uncover inefficiencies and savings opportunities.

- Automated compliance templates

- Ready-to-use frameworks aligned with GRI, SASB, CSRD, and SEC rules.

- Automatically updated as regulations evolve, reducing the risk of errors.

- Real-time dashboards & analytics

- Provides intuitive visualization tools such as heatmaps and BI dashboards.

- Helps teams monitor KPIs, spot trends, and make data-driven decisions faster.

- Fault detection & diagnostics (FDD) with continuous commissioning

- Uses algorithms and sensors to detect system faults or inefficiencies (e.g., HVAC, lighting).

- Supports ongoing commissioning to keep buildings performing optimally.

- Facilio enhances this with features like root cause analysis, cost impact assessment, and automated alarm-to-work-order conversion.

- Integration with existing systems

- Seamlessly connects with procurement tools, IoT platforms, facility management systems, and building automation technologies.

- Ensures ESG data isn’t siloed but tied to core business operations.

- Audit-ready disclosures & transparency

- Maintains a verifiable trail of data sources and calculations.

- Simplifies third-party verification and builds trust with stakeholders.

- Scenario analysis & forecasting

- Models different regulatory and operational outcomes.

- Helps leadership plan and set realistic decarbonization targets.

- Collaboration & role-based access

- Enables multiple teams—procurement, operations, sustainability—to work on ESG data without overlap.

- Supports workflows, approvals, and accountability across departments.

Benefits of ESG reporting software

- Increased efficiency: Automates data collection and reporting, cutting down manual effort and reducing errors.

- Improved transparency: Delivers consistent and reliable ESG performance data for stakeholders and investors.

- Enhanced decision-making: Provides real-time, accurate insights to guide sustainability strategies and business decisions.

- Better compliance: Simplifies alignment with frameworks like GRI, SASB, CSRD, and evolving ESG regulations.

- Stronger brand reputation: Demonstrates commitment to sustainability, improving customer trust and market positioning.

Top 14 ESG Reporting Software in 2025: Quick Comparison

Top 14 best ESG reporting software in 2025

Let’s discover the leading ESG reporting software solutions for 2024. We’ll be discussing key features of each solution and for whom it's best suitable.

- Facilio

- Workiva

- IBM Envizi ESG Suite

- Workday Adaptive Planning

- Ethos Tracking

- Nasdaq OneReport

- Persefoni

- AuditBoard

- Ecovadis

- FigBytes

- ESGenius!

- Novisto

- Galooli

- Rampart AI

1. Facilio - ESG reporting built for connected buildings

Unlike point solutions that focus on one function, Facilio delivers a fully integrated ESG reporting platform powered by IoT, cloud, and real-time data. It helps organizations track their environmental impact, cut energy costs, and achieve sustainability goals faster.

Seamless data integration

Facilio connects with your existing systems—multi-vendor building automation, HVAC, BIM, sensors, and business apps—bringing all ESG data into one centralized platform. No silos, no manual stitching.

Accurate emissions tracking

With built-in utility tracking and benchmarking, Facilio calculates emissions at a granular level. From bills to submeters, every data point is captured and converted into standardized GHG equivalents—automatically, with zero manual errors.

Automated conversions & reliable data

Forget inconsistent spreadsheets. Facilio applies verified conversion factors to ensure data consistency, accuracy, and comparability across your portfolio. That means ESG disclosures you and your stakeholders can trust.

Actionable reporting & visualization

Facilio’s reporting engine transforms raw data into clear, audit-ready disclosures. Interactive dashboards, heat maps, and visual analytics make it easy to spot patterns, anomalies, and opportunities for optimization—so teams can act, not just report.

Benchmarking that drives progress

Go beyond compliance. Facilio enables you to benchmark performance against industry standards and peer portfolios, highlighting exactly where improvements are needed to meet and exceed sustainability goals.

Why Facilio stands out

- End-to-end platform: ESG reporting, energy management, predictive maintenance—all in one place.

- Scalable and cloud-native: Fast onboarding and easy customization for enterprises of any size.

- Future-proof: Designed to evolve with changing compliance needs and net-zero strategies.

What users say about Facilio

“Exceeding the highest benchmarks for sustainable design and construction has been a top priority for us right from the start. DWTC supports the UAE’s sustainability agenda and our deployment with Facilio is in line with our efforts to achieve optimal efficiency of energy consumption and operations at One Central in a sustainable manner across our facilities which include offices, hotels, shops, among others.”

AVP, Destination Management, Dubai World Trade Centre

What Facilio users have achieved:

- British Land, a leading property development and investment company located in London, UK, went from siloed data systems and manual reporting to a 50% reduction in lightning and energy costs in 2 months with Facilio’s connected CMMS.

- One of London’s busiest airports was challenged by energy wastage due to a legacy BMS. By deploying dynamic asset operational schedules via a connected O&M platform like Facilio, energy savings of £10,000 per month were realized by consistent set point optimization.

Rating - 4.0 ⭐️⭐️⭐️⭐(Based on Capterra reviews )

2. Workiva

Workiva is a cloud-based platform that facilitates ESG reporting and compliance processes. It offers real-time collaboration, data integration, and validation features to improve data accuracy and transparency in ESG reporting. The platform serves companies of all sizes seeking a comprehensive solution for ESG reporting and compliance.

Key Features of Workiva

- Provides customizable reporting templates for ESG metrics

- Collaboration tools for team input and review

- Audit trail functionality for transparency and compliance

Best suited for

Businesses in the banking, energy and utilities, higher education, insurance, and investments sectors

3. IBM Envizi ESG Suite

IBM Envizi ESG Suite is an AI-driven platform designed to help companies manage and report on their ESG performance. It assists in data collection, analysis, and reporting across environmental, social, and governance aspects. The suite targets large enterprises seeking advanced ESG analytics and reporting capabilities.

Key Features of IBM Envizi ESG Suite

- Data management capabilities that allow organizations to collect, store, and manage a wide range of environmental, social, and governance (ESG) data

- Acts as a single repository for ESG data

- Available in seven languages including English, French, German, Italian, Spanish, Brazilian-Portuguese and Japanese.

Best suited for

Enterprises and large corporations

4. Workday Adaptive Planning

Workday Adaptive Planning is a cloud-based financial planning and analysis software that includes ESG reporting capabilities. It enables companies to integrate ESG data into their financial planning and assess the impact of sustainability initiatives on financial performance.

Key Features of Workday Adaptive Planning

- Tools for assessment of ESG metrics

- Intuitive dashboards and reports provide a single source of truth so businesses can spot trends

Best suited for

Finance and sustainability teams are aiming to align financial and ESG strategies.

5. Ethos Tracking

Ethos Tracking offers an ESG data management platform that streamlines data collection, monitoring, and reporting for sustainability performance. It aims to improve data transparency and efficiency in the reporting process. The platform serves organizations of various sizes and industries looking for efficient ESG data management and reporting.

Key Features of Ethos Tracking

- Provides a quantitative materiality assessment tool so you can track the most critical sustainability issues

- Simplifies the complexity of ESG reporting by providing one score

Best suited for

Businesses in various sectors, such as nonprofits, foundations, businesses, and families

6. Nasdaq OneReport

Nasdaq OneReport is an ESG reporting and data management platform that assists companies in gathering and reporting sustainability information in line with various reporting frameworks and standards. It automates data collection and aligns with multiple reporting frameworks. The platform primarily serves organizations looking for efficient ESG reporting aligned with different standards.

Key Features of Nasdaq OneReport

- Provides custom metrics, KPIs, and GHG calculations

- Offers intelligent survey workflows and audit trails

- Provides tools for creating corporate sustainability reports

Best suited for

Both public and private companies

7. Persefoni

Persefoni is an AI-driven ESG reporting platform that helps businesses measure, monitor, and reduce their carbon footprint. It offers advanced carbon tracking, real-time insights, and comprehensive carbon reporting. The platform is designed for companies seeking to manage and disclose their carbon-related data and risks.

Key Features of Persefoni

- Helps calculate carbon emissions

- Provides tools for planning emission reduction

Best suited for

Finance companies

8. AuditBoard

AuditBoard offers an integrated platform for risk management, compliance, and ESG auditing, helping companies ensure compliance with ESG reporting requirements and internal controls. It simplifies audit processes and provides compliance tracking capabilities. The platform is useful for organizations seeking to strengthen their ESG auditing and compliance practices.

Key Features of AuditBoard

- Helps documentation and editing of audit reports

- Provides collaboration tools for communication in the audit process

- Sync with PDF and Excel files

Best suited for

Fortune 500 companies

9. Ecovadis

Ecovadis provides a collaborative platform for assessing and monitoring the sustainability performance of suppliers. It offers supplier-focused sustainability assessments, a global supplier database, and benchmarking capabilities. The platform primarily serves companies looking to assess and improve the sustainability performance of their supply chain.

Key Features of Ecovadis

- Provides customizable assessment questionnaires based on the company’s size, location, industry, etc

- Provides detailed insights regarding value chain risks

- Integrates with third-party tools

Best suited for

Companies of any size and industry

10. FigBytes

FigBytes is an enterprise ESG and sustainability management platform that assists organizations in collecting, analyzing, and reporting ESG data. It offers customizable reporting and scenario analysis for sustainability planning. The platform targets companies across industries, aiming to enhance their ESG and sustainability reporting.

Key Features of FigBytes

- Provides tools for stakeholder engagement

- Collects, centralizes, and calculates ESG and sustainability data

- Includes scenario analysis capabilities for achieving net-zero goals

Best suited for

Companies in various sectors such as government, healthcare, technology, etc

11. ESGenius!

ESGenius! is an ESG data analytics platform that leverages AI to help companies identify ESG risks and opportunities. It offers real-time monitoring and industry-specific ESG analysis. The platform serves companies seeking AI-driven ESG analytics to improve sustainability performance.

Key Features of ESGenius!

- AI and machine learning technology enable users to set baselines and share ESG ratings with investors

- Compliance management tools to help businesses comply with ESG regulations

Best suited for

Small-and-medium-sized businesses, public and private companies, investment firms, and financial institutions.

12. Novisto

Novisto offers an ESG performance management platform that integrates ESG data into performance management strategies. It provides customizable reporting and data visualization. The platform serves businesses looking to align ESG considerations with overall performance management.

Key Features of Novisto

- It offers hundreds of ESG benchmarks that you can measure

- The user interface is simple to navigate

- Report builder for all major standards and frameworks such as GRI, SASB, TCFD, and more

Best suited for

Businesses in the private capital, security, and technology sectors

13. Galooli

Galooli offers an IoT-based ESG software platform that helps businesses monitor and optimize energy consumption, reduce emissions, and improve overall sustainability. It provides IoT-driven energy monitoring, data analytics, and cost-saving solutions. The platform serves organizations aiming to enhance their energy efficiency and sustainability efforts.

Key Features of Galooli

- KPI tracking for measuring energy and carbon metrics

- Remotely manage energy assets

- Predictive real-time alerts to identify maintenance needs

Best suited for

Businesses in the renewables, telecommunications, data centers, facilities, microgrids, and utilities industries

14. Rampart AI

Rampart AI is an ESG data analytics platform that leverages AI for ESG insights and real-time monitoring. It targets companies seeking to identify ESG risks and opportunities based on data-driven insights.

Key Features of Rampart AI

- An interactive dashboard that provides overview of key sustainability metrics

- Rapidly integrates with existing data sources

Best suited for

Businesses in the finance, technology, and healthcare industries

How to choose the best ESG reporting software

With so many ESG reporting solutions available, finding the right fit comes down to aligning the software with your organization’s goals, scale, and reporting needs. The best ESG reporting software should not only meet compliance requirements but also integrate seamlessly into your operations and add long-term value.

Key checklist for evaluation

When assessing options, look for these must-have factors:

- Scalability: Can the platform handle growth across multiple sites, portfolios, or regions as your ESG program expands?

- Compliance coverage: Does it support major frameworks like GRI, SASB, CSRD, and SEC disclosures—and update automatically as regulations change?

- Ease of use: Is the interface intuitive enough for both sustainability teams and non-technical users?

- Integrations: Can it connect with existing business systems like procurement tools, IoT platforms, and facility management software?

- Industry fit: Does the platform offer features tailored to your sector—for example, real estate energy monitoring or supply chain sustainability benchmarking?

A simple 5-step framework to guide selection

- Define your goals - Clarify what matters most—regulatory compliance, emissions reduction, investor transparency, or operational efficiency.

- Map your data sources - List all sources of ESG data across facilities, supply chain, HR, and finance. Ensure the software can consolidate them without silos.

- Evaluate core features - Prioritize platforms with automated reporting templates, real-time analytics, and benchmarking tools that align with your objectives.

- Test usability & scalability - Run pilots with different teams to assess usability, onboarding speed, and ability to scale across portfolios.

- Check for long-term support - Look for continuous updates, responsive customer support, and flexibility to adapt as reporting requirements evolve.

By following this approach, organizations can cut through the noise and identify the best ESG reporting software for their unique context. Instead of choosing a tool that just checks compliance boxes, this framework ensures you invest in an ESG reporting solution that drives efficiency, accountability, and measurable sustainability progress.

Turning building data into ESG impact with Facilio

Most ESG reporting tools are designed as generic solutions.

They help companies meet compliance requirements but often fall short when it comes to industry-specific needs, especially for facilities and real estate portfolios where operational complexity is high and data is scattered across multiple systems.

This is where Facilio sets itself apart.

Facilio is purpose-built for real estate and facilities teams.

Unlike point solutions that only track emissions or utility data, Facilio integrates directly with building systems, IoT sensors, and operational platforms, turning raw operational data into real-time ESG insights. This means you’re not just reporting on past performance—you’re continuously monitoring and improving sustainability outcomes across your portfolio.

What makes Facilio unique?

- Real-time ESG reporting powered by building data: Capture, process, and report emissions, energy, and resource usage as they happen—not months after the fact.

- Seamless integration: Connects with multi-vendor building automation systems, HVAC, BIM, and business applications for a unified ESG view.

- Actionable intelligence: Go beyond compliance reporting with dashboards, fault detection, and benchmarking that pinpoint inefficiencies and improvement opportunities.

- Tailored for scale: Whether managing a few buildings or an entire global portfolio, Facilio’s cloud-native platform scales effortlessly.

- Future-ready compliance: Automated templates keep pace with evolving ESG frameworks like GRI, SASB, and CSRD—so you stay compliant without rework.

By bridging the gap between operational performance and sustainability reporting, Facilio empowers enterprises to meet regulatory demands while also achieving cost savings, efficiency, and long-term resilience.

If your goal is not just to report ESG metrics but to transform operations into a driver of sustainability, Facilio offers a solution designed for you.

FAQs:

1. What are ESG reporting tools?

ESG reporting tools are software that help organizations manage, track, and analyze ESG-related data. They collect data from various sources and analyze it so that end-users can identify insights. For instance, they might reveal that a company's carbon emissions have decreased over the past year, indicating progress in environmental sustainability efforts.

2. Which are the three pillars of ESG?

The three pillars of ESG are:

1. Environmental: This pillar focuses on a company's impact on the natural environment, including aspects such as carbon emissions, energy efficiency, waste management, and resource conservation.

2. Social: The social pillar pertains to a company's relationships with its stakeholders, including employees, customers, communities, and suppliers. It encompasses issues like labor practices, human rights, diversity and inclusion, health and safety, and community engagement.

3. Governance: Governance relates to the systems and processes by which a company is directed and controlled. It includes factors such as board diversity, executive compensation, shareholder rights, transparency, ethics, and risk management.

3. What types of organizations can benefit from using ESG reporting software?

Various types of organizations can benefit from using ESG reporting software. These can range from large corporations, investment firms, government organizations, to real estate companies. Overall, any organization seeking to improve its sustainability performance, enhance stakeholder engagement, and drive positive social and environmental outcomes can benefit from implementing ESG reporting software.

More from Facilio