Featured Refrigeration Monitoring

EPA Refrigerant Phaseout Schedule 2025: Deadlines & Next Steps

The EPA’s HFC phase-downThe EPA's HFC refrigerant phase-down tackles a critical environmental issue: the damaging impact of HFCs on the global climate. is bringing big changes to how the HVAC and refrigeration industry handles compliance, cost, and long-term planning.

With the first major HFC reductions already in effect (from 2024)—and steeper reductions coming by 2028 and beyond—facilities teams can’t afford to be caught off guard.

In the next few minutes, we’ll break down the EPA’s latest refrigerant phaseout timeline, what each milestone means for your operations, and how you can stay compliant, control costs, and get ahead of the curve as the industry moves toward low-GWP alternatives.

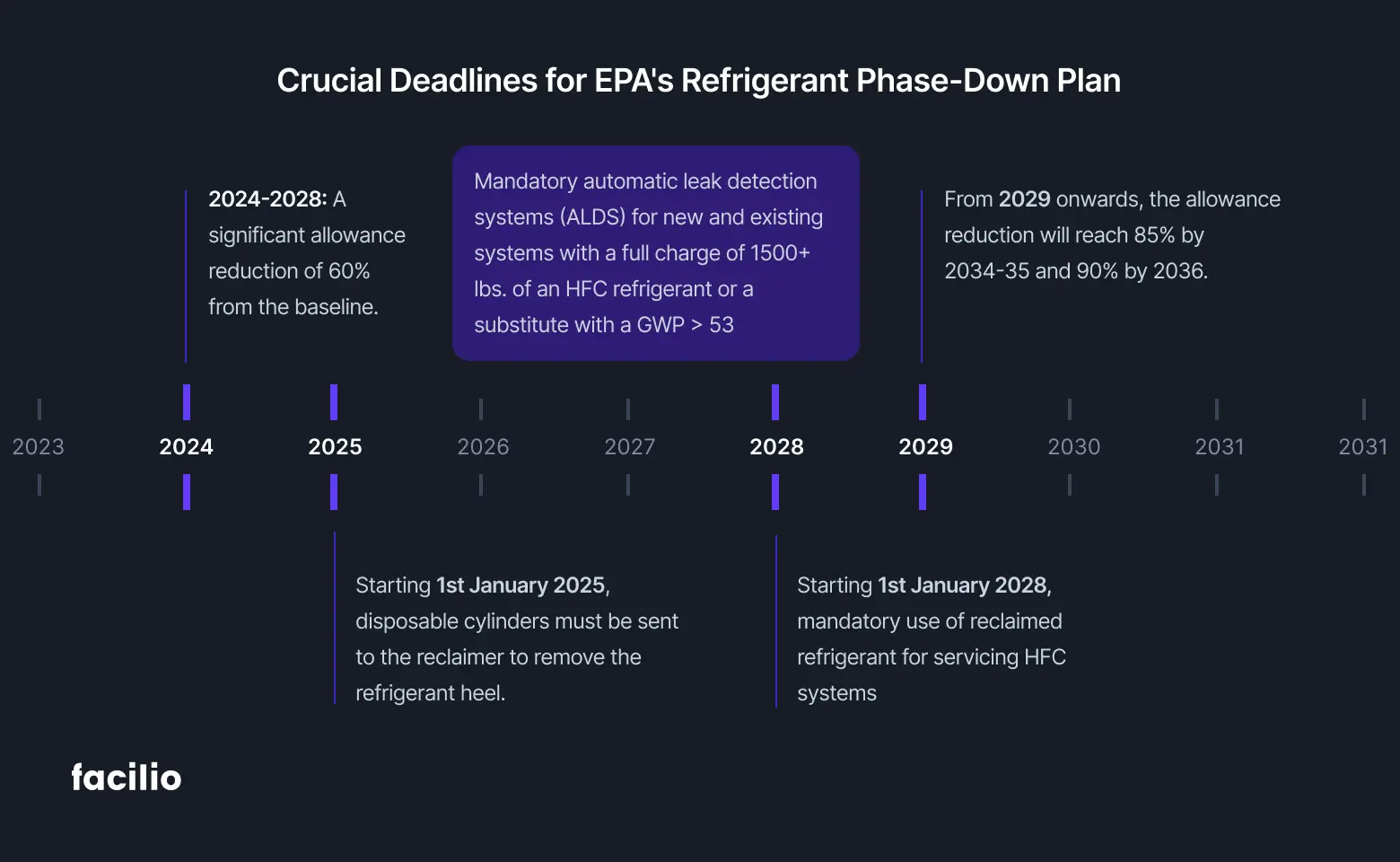

EPA Phase down at a glance: What’s changing in each phase from 2024 to 2036?

To help you plan ahead, here’s a snapshot of the EPA’s official HFC phaseout schedule. These milestones define when the biggest reductions happen, what you can expect for refrigerant supply, and how each stage raises the stakes for compliance and cost.

2024:

- 40% reduction in allowed HFC production and imports compared to the baseline

- R-410A, R-404A, and other high-GWP refrigerants are beginning to face tighter restrictions in new equipment

2025:

- Stricter disposal and reclamation rules for refrigerant cylinders begin (no more disposable cylinders without reclamation; heel removal required)

- Early price increases and supply shortages start to impact service budgets

2028:

- Mandatory use of reclaimed refrigerant for servicing HFC equipment begins

- Preparation for another large phase-down cut

2029:

- Allowable HFC production and import drops by 70% from baseline

- Service and replacement refrigerant supplies become much tighter; alternative adoption accelerates

2034–2035:

- HFC allowances cut by 80%+; only essential or specialty uses permitted

2036 and beyond:

- Final target: 85% reduction in HFC production and import

- HFCs are only allowed in highly restricted applications; compliance risk and costs are at their peak

What is the EPA refrigerant phaseout?

The EPA's HFC refrigerant phase-down tackles a critical environmental issue: the damaging impact of HFCs on the global climate.

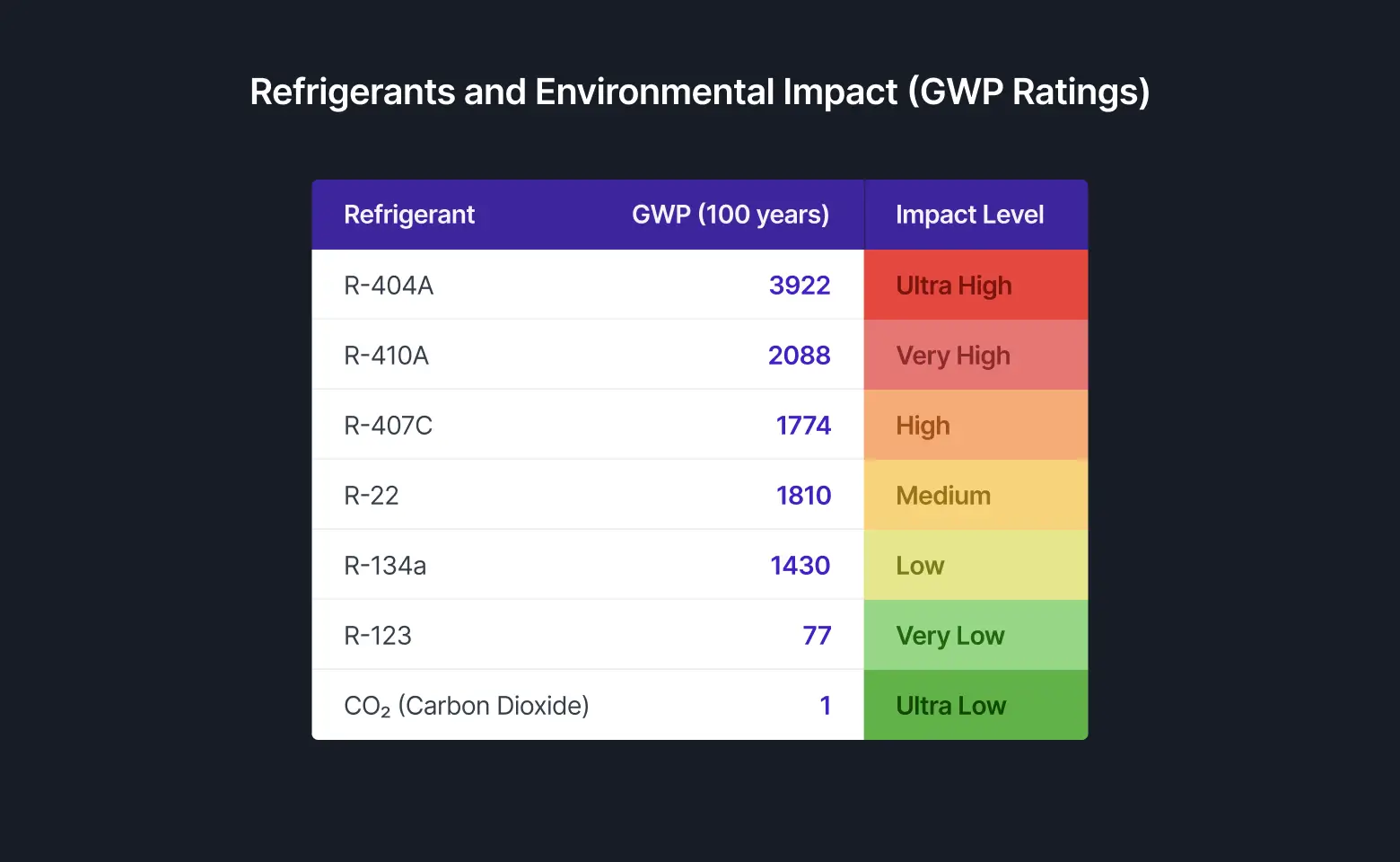

HFCs, common refrigerants in HVAC and refrigeration systems, were hailed as a safer alternative to ozone-depleting CFCs. However, HFCs are potent greenhouse gases, trapping more heat than CO2 in the atmosphere and contributing to global warming.

To address this growing concern, the EPA, empowered by the 2020 AIM Act, launched a comprehensive HFC phaseout program for U.S. production and consumption. This multi-layered plan reduces HFC allowances and substantially cuts HFC use over the next decade.

The HFC phasedown schedule, as envisaged by the EPA, is as follows:

- 2022–2023: 10% reduction from baseline levels.

- 2024–2028: 40% reduction.

- 2029–2033: 70% reduction.

- 2034–2035: 80% reduction.

- 2036 and beyond: 85% reduction.

The EPA's ambitious goal is to achieve an 85% reduction in HFC consumption by 2036 is expected to pave the way for a smooth transition to more environmentally friendly alternatives. This initiative aims to encourage the development, adoption, and widespread use of refrigerants with a significantly lower global warming potential.

Key refrigerants affected

The EPA’s HFC phaseout program impacts several refrigerants, including:

- R-404A: Commonly used in commercial refrigeration for low-temperature applications

- R-134a: Used primarily on commercial chillers and older vehicle ACs

- R-410A: Used widely in commercial and residential ACs and chillers

- R-407C: Employed as a replacement for R-22 in existing ACs and refrigeration systems

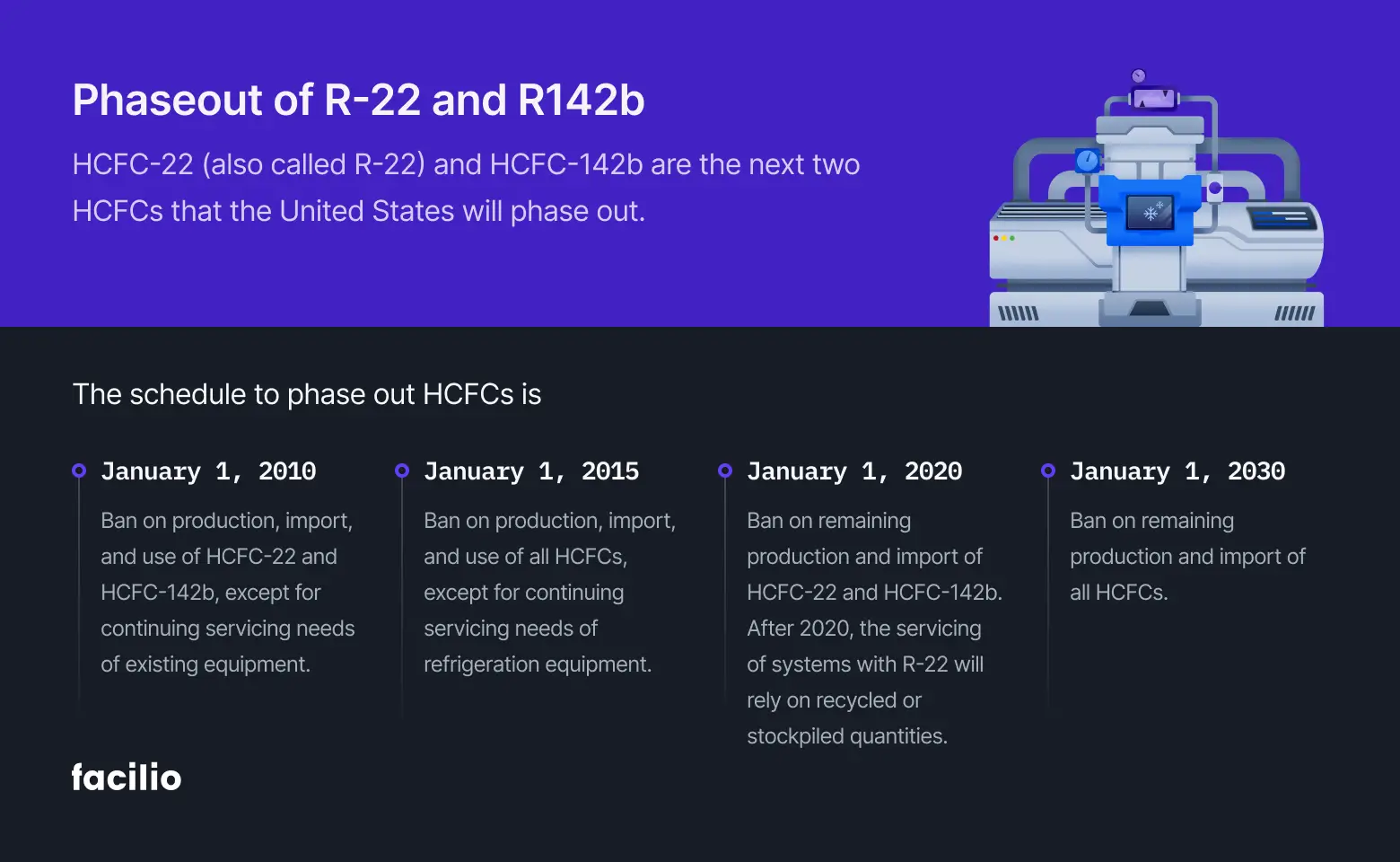

- R-123 and R-22: These HCFC refrigerants are used in commercial cooling applications like HVAC and refrigerators

Detailed timeline of the EPA refrigerant phase-out schedule

The EPA’s HFC phaseout program is already underway and establishes production and consumption baselines following the formulas outlined in the AIM Act. These baselines serve as a reference point for allowable production and consumption levels, which will gradually decrease each year according to a predefined schedule within the AIM Act.

A table summarizing the consumption and production limits for the HFC phaseout is provided below. Additionally, the EPA issues allowances for HFC production and import on an annual basis, typically by October 1 of the preceding year.

Key EPA regulations that you should be aware of

- In new chiller production, HFC refrigerants like R-404A and R-410A are prohibited from 1st January 2024.

- The production of new equipment using R-22 ceased entirely in 2022, and the HCFC phaseout will be completed in 2030.

What are the alternatives to phased-out refrigerants?

With high-GWP HFCs like R-410A and R-404A facing steep restrictions, facilities and retail leaders must plan the shift to next-generation refrigerants. Choosing the right alternative is about more than compliance—it’s a critical operational and financial decision.

Here’s what you need to know about the most common EPA-approved alternatives:

- R-32:

- Widely used in new air conditioners and heat pumps

- Lower global warming potential (GWP) than R-410A

- High efficiency, but mildly flammable (A2L)—may require technician upskilling and updated safety protocols

- R-454B:

- Emerging as the preferred replacement for R-410A in commercial applications

- Even lower GWP than R-32

- Requires compatible equipment and A2L safety measures

- CO₂ (R-744):

- Natural refrigerant with ultra-low GWP

- Ideal for supermarkets, cold storage, and industrial uses

- Requires higher operating pressures and specialized components

- Ammonia (R-717):

- Common in large industrial refrigeration

- Zero GWP and excellent efficiency, but toxic and requires specialized handling

- Propane (R-290):

- Ultra-low GWP, increasingly used in commercial refrigeration and small equipment

- Flammable (A3), so often limited to smaller charge sizes

What to consider:

- Retrofit or replace? Not all systems can be retrofitted—consult OEM guidelines.

- Training: New refrigerants may require updated certifications and procedures.

Tech advantage: Using Connected refrigeration software can help track refrigerant inventory, leak rates, and compliance across multiple sites.

Future EPA deadlines to keep an eye on

Here are some future deadlines to watch out for in the HFC phaseout programs, especially for allowance reduction:

- 2024-2028: A significant allowance reduction of 60% from the baseline. Expect tighter restrictions on HFC availability and inflated prices.

- From 2029 onwards, the allowance reduction will reach 85% by 2034-35 and 90% by 2036. This will necessitate a substantial change in the business approach and the refrigerant used.

- Mandatory automatic leak detection systems (ALDS) for new and existing systems with a full charge of 1500+ lbs. of an HFC refrigerant or a substitute with a GWP > 53

- Starting 1st January 2028, the mandatory use of reclaimed refrigerant for servicing HFC systems

- Starting 1st January 2025, disposable cylinders must be sent to the reclaimer to remove the refrigerant heel.

Impact of the EPA refrigerant phaseout schedule on different industries

As mandated by the AIM Act, the EPA’s HFC phaseout program is being carried out in three ways:

- Phasing down production and consumption: Gradually reducing the production and consumption of HFCs to 15% of baseline levels by 2036.

- Maximizing reclamation and minimizing releases: Encouraging the reclamation of existing HFCs and minimizing their release from equipment to reduce environmental impact.

- Facilitating the transition to next-generation technologies: Implementing sector-based restrictions to promote the adoption of environmentally friendly alternatives with lower global warming potentials (GWPs).

Basant Singhatwadia, Director of Customer Success, Facilio

However, the HFC phasedown presents a major challenge: identifying suitable alternatives that match the performance and compatibility of existing systems.

Additionally, the cost of new refrigerants and system upgrades, and training technicians to handle low-global warming potential (GWP) systems pose hurdles to a smooth phaseout of HFCs.

Industries most impacted by the phasedown include

- Refrigeration and air conditioning (HVAC/R): This industry will experience a full-blown shift. Manufacturers must develop and procure equipment compatible with low-GWP alternatives, while service technicians will require training to handle new refrigerants safely.

- Retailers: Supermarkets and retail stores must maintain proper temperature in freezers and display cases. They will now have to find cost-effective and energy-efficient replacements for their existing HFC refrigerators.

- Cold storage warehouses: Cold storage warehouses require consistent cooling for perishable goods.

- Industrial process facilities: Food processing, pharmaceuticals, and chemical manufacturing rely heavily on HFC-based refrigeration for temperature control. They will now have to find efficient replacements to ensure smooth operation.

- Data centers: These facilities rely on efficient cooling systems to maintain optimal temperatures for servers and other critical equipment. The phasedown necessitates the adoption of alternative refrigerants and potential upgrades to existing cooling infrastructures to ensure compliance and maintain operational efficiency.

- Transportation: The transportation sector, including refrigerated transport and vehicle air conditioning, accounts for approximately 8% of HFC use in the United States. The phasedown will require the development and integration of low-global warming potential (GWP) refrigerants in vehicles and transport refrigeration units.

How businesses can prepare for the transition with Facilio

The EPA’s refrigerant phaseout schedule might seem daunting, but it represents a prime opportunity for multi-site retail stores and other operators to modernize their refrigeration management.

People also read: Achieving Superior Refrigeration Control and Lower Energy Costs

Apart from transitioning away from high-GWP refrigerants, the new regulations also require robust refrigerant oversight, including quarterly manual inspections or continuous refrigeration monitoring via automated leak detection systems. While this added diligence might seem like a burden, it’s actually an opportunity to optimize operations and reduce long-term costs.

Here’s how you can stay ahead of the regulations and smoothen your transition:

- Upgrade your equipment

The transition starts with upgrading to more energy-efficient equipment. Not only does this help offset initial costs, but it also leads to substantial operational savings over time. Here's how to approach it:

- Develop a strategic upgrade plan based on your current systems’ age, efficiency ratings, and maintenance needs.

- Prioritize replacing outdated HFC-based equipment while taking into account the new regulations regarding refrigerant charge limits and leak detection requirements.

a) Appliances with 15+ lbs. of HFC refrigerant or a substitute with a GWP > 53 for large commercial setups.

b) Mandatory automatic leak detection systems (ALDS) for new and existing large systems with over 1500+ lbs. of HFC refrigerant or a substitute with a GWP > 53.

You can also consider retrofitting older systems with conversion kits that utilize low-GWP alternatives.

2. Stay up to date on HVAC/R Tech

The industry is rapidly evolving, especially when it comes to low-GWP refrigerant solutions. Stay ahead by attending trade shows, engaging with new product releases, and always keeping an eye out for innovative HVAC/R technologies.

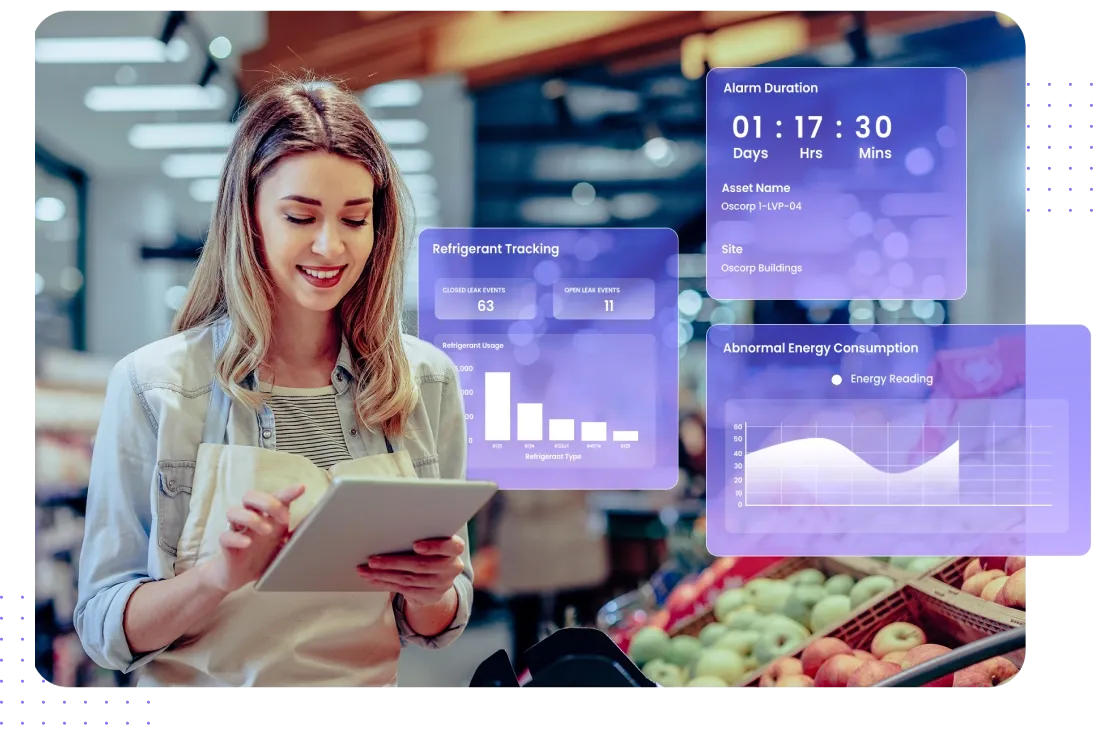

3. Leverage IoT-based connected refrigeration CMMS software like Facilio

This may be the most crucial and effective step in preparing for the transition.

The AIM Act goes beyond simply preventing the use of environmentally damaging gases. It also takes a proactive approach by regulating leak detection and strict compliance management.

The penalties for non-compliance can be steep—up to $57,617 per system violation per day. That’s not including the increased scrutiny and paperwork!

And this is exactly where Facilio comes in.

To manage refrigeration compliance, a CMMS platform like Facilio offers potent solutions to navigate the HFC phaseout.

Facilio offers an innovative, enterprise-grade refrigeration management solution that streamlines compliance and optimizes performance. This unified platform simplifies compliance, detection, and leak management. Here's what Facilio provides:

- Proactive compliance management and monitoring to handle leaks, repairs, retrofitting, and installations.

- Automated leak detection across different contractors and locations

- Easy audits with standardized refrigerant tracking

- Remote hardware monitoring for continuous oversight.

- Real-time alerts and analysis to identify and address potential leaks immediately.

- Cloud-based tools to remotely monitor your refrigeration systems and predict slow leaks, even without sensors.

- Smart analytics to eliminate false or unnecessary alerts

- Integration with industry standards like CARB, GreenChill, and ESG

- A low-code/no-code platform to automate key processes.

As the EPA’s HFC phaseout regulations come into full effect, adopting software-led refrigerant tracking systems like Facilio is more critical than ever.

Why?

Because it’s no longer just about compliance—it’s about becoming operationally efficient, reducing risks, and positioning your business as a sustainability leader in the industry.

Future-proof your refrigeration systems against any regulatory changes with Facilio

Transitioning from HFCs may be challenging, but it could well be a blessing in disguise for companies with a will to innovate, improve profitability, and make a positive impact on the environment.

Switching to Facilio's refrigerant detection software now presents an opportunity for grocery and cold storage operators to reduce risks, improve profitability, minimize environmental impact, and demonstrate stewardship today instead of scrambling to meet new federal and state compliance requirements without the headache.

Take King Kullen, one of America’s leading supermarket chains.

King Kullen deployed Facilio’s Connected Retail platform to transform its refrigeration compliance management—automating tracking, gaining real-time visibility, and ensuring seamless EPA compliance. With proactive alerts and data-driven insights, they stay ahead of risks while optimizing operations.

See how Facilio can help you future-proof your refrigeration systems and navigate the HFC phaseout with ease, just like King Kullen.

Future-proof your refrigeration systems and seamlessly navigate the HFC phaseout with Facilio

Schedule Your Demo NowFrequently asked questions

1. Which refrigerants are being phased out by 2030?

By 2030, the EPA is targeting high-GWP refrigerants such as R-404A, R-410A, and R-134a for phaseout, with supply dropping by 70% by 2029 and 80% by 2034. R-22 and other HCFCs are also part of the long-term phaseout plan.

2. What is the EPA’s timeline for phasing out HCFCs and HFCs?

The EPA ended production of most HCFCs, including R-22, in 2020. HFCs like R-410A and R-404A are seeing major reductions starting in 2024, with additional cuts in 2025, 2028, 2029, and 2034–2036. The final goal is an 85% reduction in HFC supply by 2036.

3. Is the EPA phasing out R-410A?

Yes. R-410A is being phased out. New equipment using R-410A faces restrictions from 2024 onward, and servicing existing systems will get harder and more expensive as supply tightens and prices rise over the next decade.

4. What is the EPA refrigerant ban in 2025?

Starting in 2025, the EPA bans disposable refrigerant cylinders unless reclaimed, enforces stricter rules on cylinder handling, and further limits the use of high-GWP HFCs in new equipment. Service and supply options for older refrigerants will continue to decline.

5. What refrigerant will replace R-410A after 2025?

The main replacements for R-410A are R-32 and R-454B. Both have lower global warming potential and are approved for use in new HVAC equipment starting in 2025 and beyond.

6. Which AC refrigerants are banned or being phased out?

R-22 was banned from new equipment after 2010, and production ended in 2020. R-410A, R-404A, and R-134a are now being phased down, with use in new systems restricted and supply for servicing existing units tightening each year.

7. Is R-410A still available for service and repair?

Yes, R-410A is still available for servicing existing equipment, but supply is shrinking as EPA milestones are reached. Prices are rising, and after 2028, only reclaimed R-410A may be used for servicing.

8. What refrigerant is replacing R-22?

For existing systems, R-407C and MO99 are the most common retrofits for replacing R-22. New systems typically use R-410A, R-32, or other low-GWP refrigerants, depending on compatibility.

9. How can facility and retail operators prepare for refrigerant phaseout?

Audit your current equipment and refrigerant inventory, plan upgrades for high-GWP systems, and train your teams on alternatives. Connected CMMS platforms can help track compliance and automate leak detection, making it easier to keep up with EPA milestones.

10. What are the financial risks of delaying upgrades during the EPA phaseout?

Delaying upgrades can mean higher prices, service shortages, compliance penalties, and unplanned downtime as refrigerant supplies dwindle. Early planning lets you budget, avoid penalties, and take advantage of incentives for low-GWP adoption.