The world is in a bit of a unique place right now. And for us in property operations it is filled with too many questions: when to reopen, how to adapt to the new SOPs, which technology to adopt, and the list goes on! That last question, which technology to adopt, is actually one of the most important things building owners should be thinking about since it helps answer the rest.

As overwhelming as operating a large portfolio might be, you’re probably not looking for a “disruptive” solution. Instead, you want the technology to help you understand what’s working in your portfolio—and what’s not working and needs attention. There’s constant pressure to improve the operational bottom line and deliver value in a competitive market. And you are taking hard decisions all the time. You want your tools and data to work together so you can have cohesive, real-time visibility into your operations and react accordingly. And you probably want everything to be simple and easy to use.

But in an industry characterized by complexities with a fragmented data and app landscape—even before the pandemic imposed constraints—visibility is everything but straightforward!

What makes operational visibility one of the biggest unsolved problems in real estate?

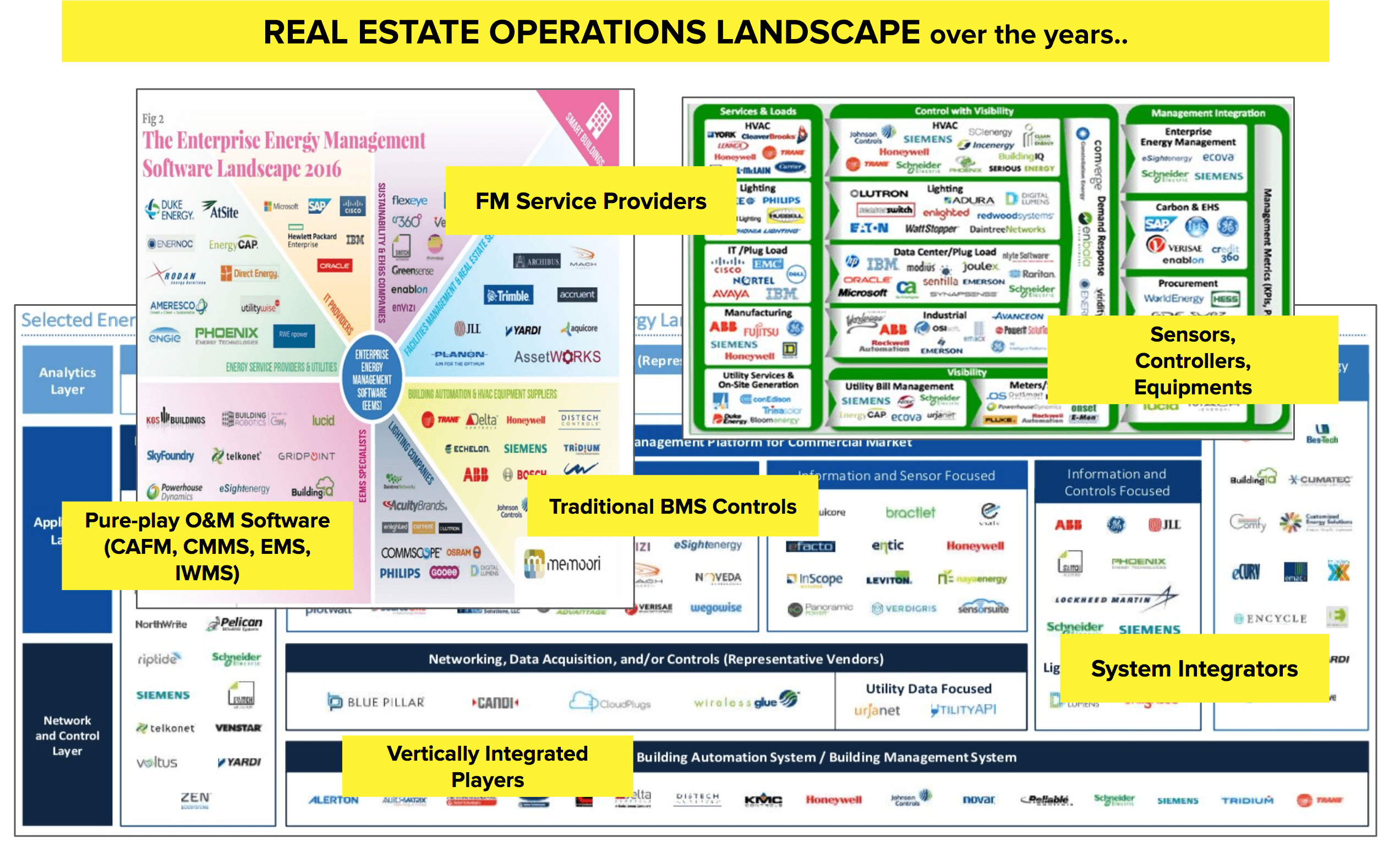

The property operations landscape has become extremely complex and decentralized. The market is increasingly fragmented in terms of data, applications and services—there are traditional building management systems, edge devices with embedded intelligence, vertically integrated players with proprietary platforms, service providers, software for vendors and accounting and just about everything else you can think of.

Source: GTMResearch, Memoori

Now consider some of your key operational blindspots. When it comes to utility performance you are likely asking questions such as: What’s causing peak energy usage in each building? How do I prevent energy cost overruns? Can I benchmark and compare retro-commissioning results across sites?

Building maintenance is also fraught with unknowns. Can I identify the failure prone equipment? Which assets should I repair, and which ones should I replace? How do I benchmark asset performance from different vendors?

If these questions still exist for metrics that are as quantifiable as energy use and equipment performance, imagine how many there are for metrics that are more subjective, such as tenant satisfaction. Can building managers answer with certainty questions such as: What are the major friction points for tenant discomfort? Which areas of the building receive the majority of the complaints? What are steps in the complaint resolution that can lead to tenant frustration?

To answer these questions, you need insights and KPIs that are grounded in real-time data. Data that unfortunately is vastly dispersed and resides as fragmented pieces of information across disparate systems, software, and service providers. Today, any attempt to capture data across these systems isn’t in a beeline. Instead, it requires manual consolidation or long dedicated system integration projects, which makes it impossible to derive meaningful insights in real-time to effectively solve your pressing challenges.

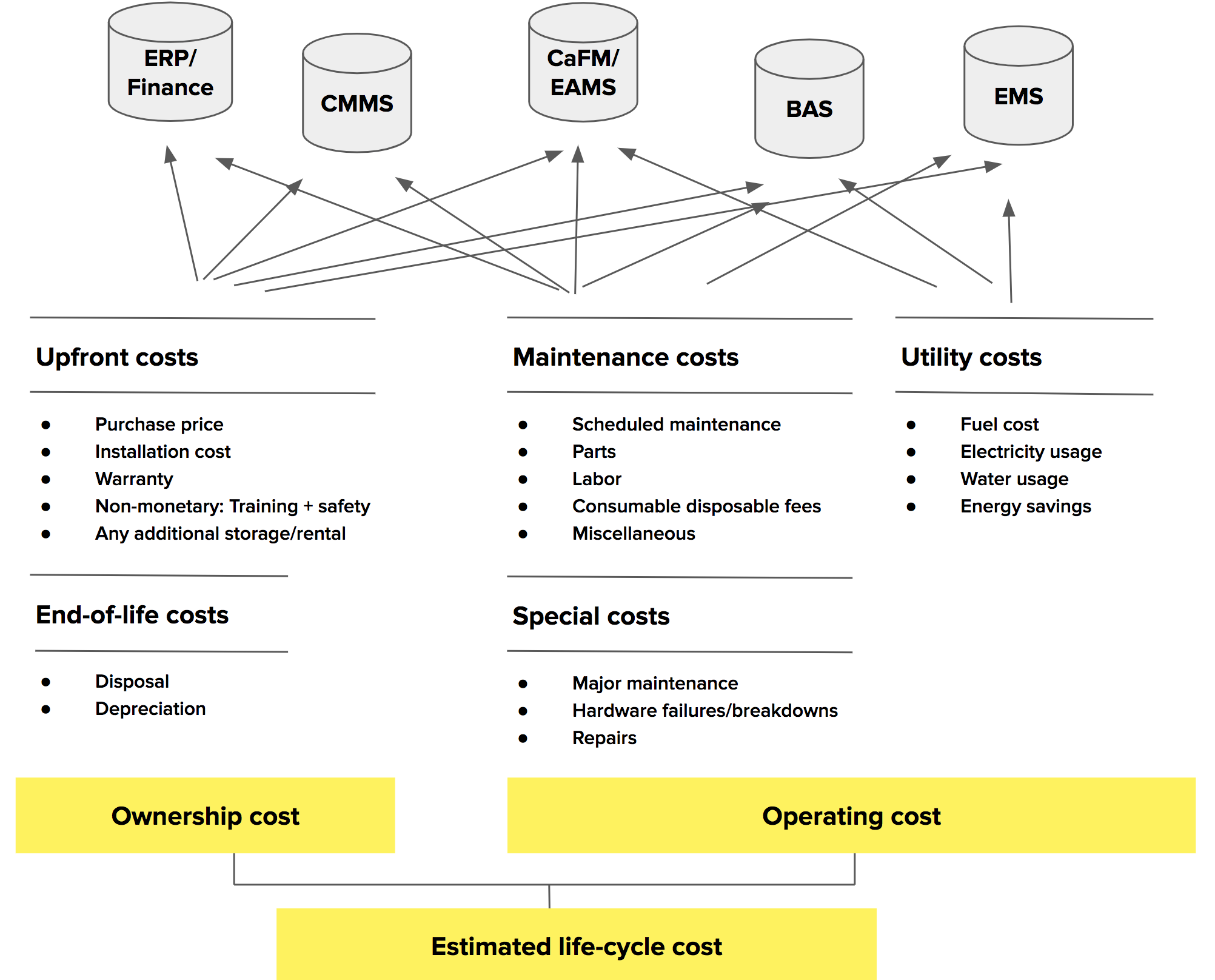

Let’s single out a KPI to understand the depth of the fragmentation problem.

About a third of HVAC equipment running in the world’s buildings is more than 20 years old. In one of the classic cases of run-to-failure, the only way to effectively evaluate replacement options (with sizable capital costs) is to perform an estimated life cycle cost analysis and compare the results with the actual performance of existing units. Most of the information you need for this estimation is available in your existing systems—but it takes months to pull all of this data together, analyze the reports, and make evidence-based purchase decisions. And by the time you have consolidated insights on the table, that data is dated and probably already obsolete.

Unfortunately, there’s a huge gap between the volume of information available in real estate operations and tools to assimilate all of this data into useful insights. The data you need is available to inform your decisions and O&M strategies—but never readily so.

Why is it important (and urgent) to have a consolidated data strategy?

Okay, so the data can be hard to consolidate. But is this really impacting the operational bottom line? Is it worth fixing?

Consider this well-known Chinese proverb:

“The best time to plant an oak tree was 20 years ago. The second best time is today.”

Data aggregation in real estate operations is much like planting an oak tree. We’d be better off if it had been addressed a couple of decades ago, but that doesn’t make it any less important to tackle today. In fact, with the pandemic imposing the need for remote and agile operations, the struggle to capture and derive meaningful KPIs has resulted in a downward spiral of operational inefficiencies.

Here are some of the most pressing inefficiencies that many buildings and portfolios face today:

Lack of a holistic operational view

With no centralized, direct access to real-time operational info, property executives have no easy way to get an accurate picture of their entire operation. The lack of visibility for key stakeholders often results in bill shocks, cost overruns, and tenant churn.

Nearly impossible to triage operational risks

Operations teams work in silos with data spread across building management tools and maintenance management systems. Too often, this results in longer outage-resolution times that can negatively impact business and tenant satisfaction. It also makes it impossible to understand cross-functional insights such as asset health from maintenance KPIs, correlating energy usage patterns and control sequences.

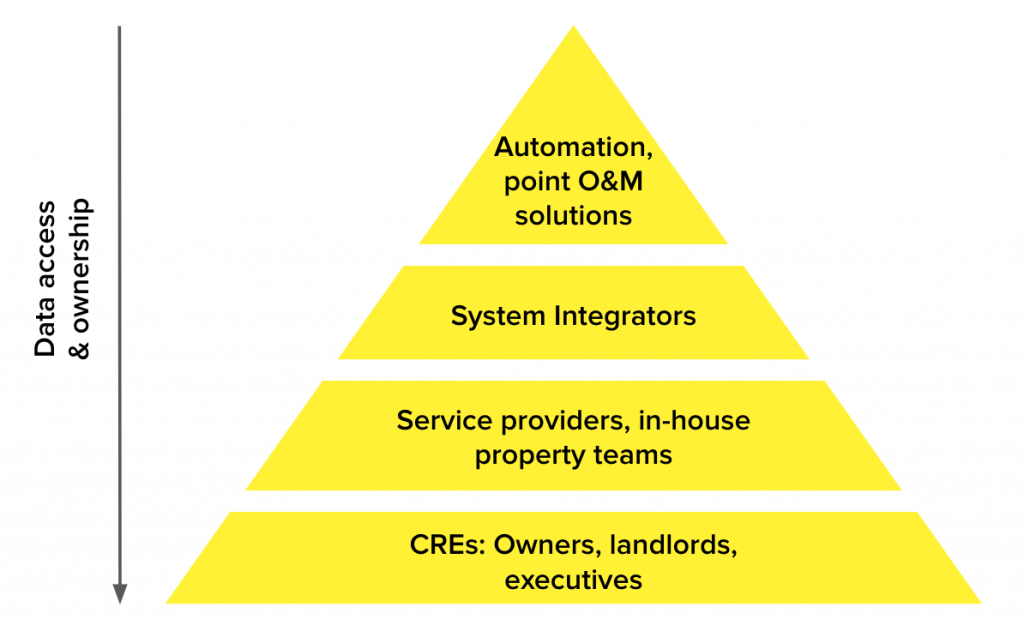

Loss of control

Owners and operators are heavily reliant on internal coordination, vendor hand-offs, and working across multiple systems and reports to understand what’s important. Many therefore feel they’ve lost control over their own portfolio. Agility is almost impossible with decision-makers at the bottom of ownership hierarchy.

These urgent operational risks notwithstanding, the lack of a common data overlay also puts real estate portfolios many steps backwards in terms of innovation.

Deters modernization

Because it can often be difficult to work with legacy systems and data sources. Without a data middleware, connecting legacy systems is slow and requires significant development time.

Makes vendor changes difficult

With no central control over your portfolio data, you are stuck with legacy solutions—despite evolving needs. In an article on the merits of an independent data layer, the author James Dice explains, “if you don’t like a FDD (Fault Detection & Diagnostics) solution, you should be able to just plug a different vendor in while you still own all the important information.”

Constrains portfolio growth and evolution

Any new systems, now location, or new analysis must be done using expensive and demanding manual coding. With constantly evolving tenant expectations, property teams need a future-ready framework to accommodate the inevitable changes in the way their buildings operate.

The bottomline is operational insights for buildings shouldn’t be this hard to surface. Simplification, not complication, should be the ultimate goal when it comes to building systems. With the help of sophisticated middleware, this can be achieved to the benefit of the entire real estate industry.

In the next part of this series, we’ll dive into how you can close this gap, drive visibility across your portfolio, and put yourself back in complete control of your operations.

Stay tuned!

Originally published in Propmodo

About Facilio

Facilio is the data-driven property operations cloud platform that aggregates operational information across RE portfolios to help owners and operators optimize performance and control operations, from one place.

Trusted by forward-thinking enterprises across 40 million sq ft of space globally, Facilio empowers RE professionals with real-time operational visibility and complete control over their portfolios.