IRS Regulations for Maintenance Teams – How to Stay Compliant and Audit-Ready

For facility maintenance teams, it’s easy to think of IRS rules as something the finance department handles. But in reality, every repair, replacement, or upgrade your team oversees has tax implications.

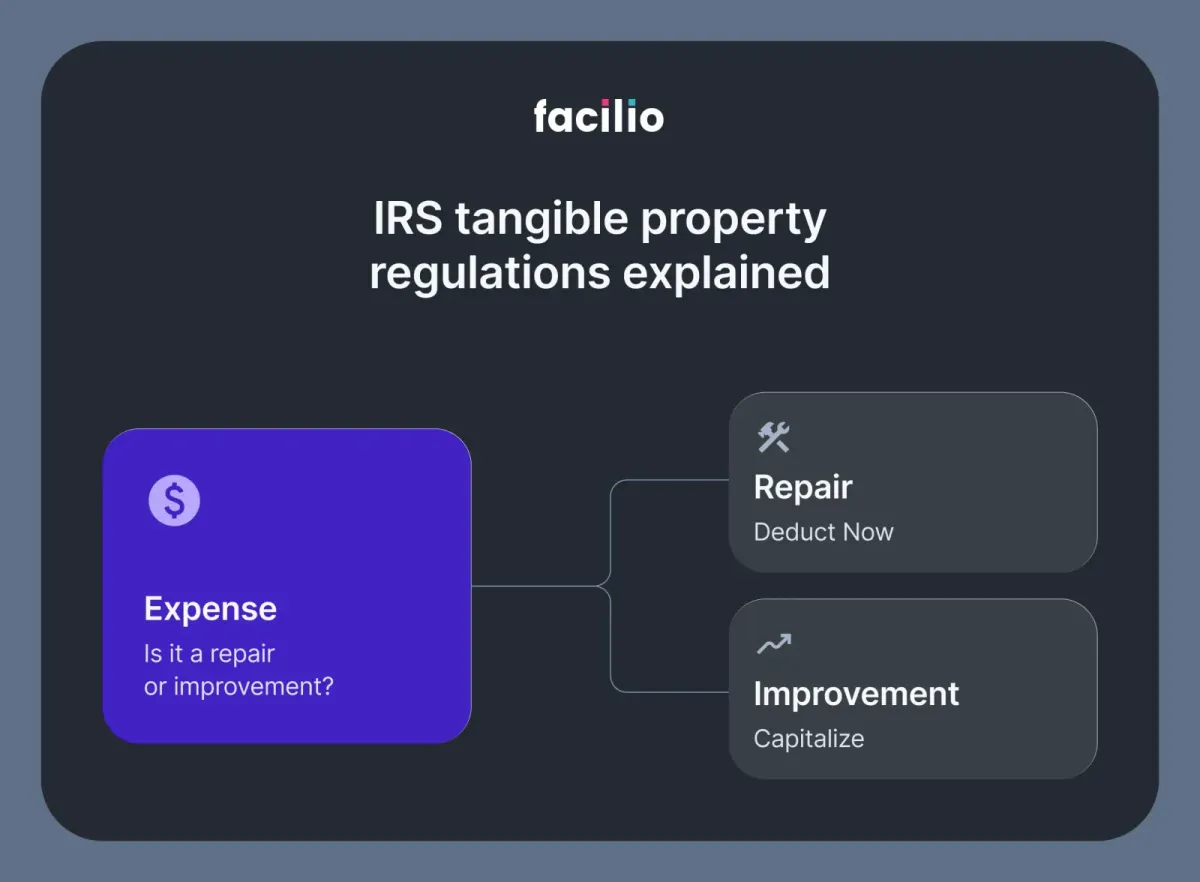

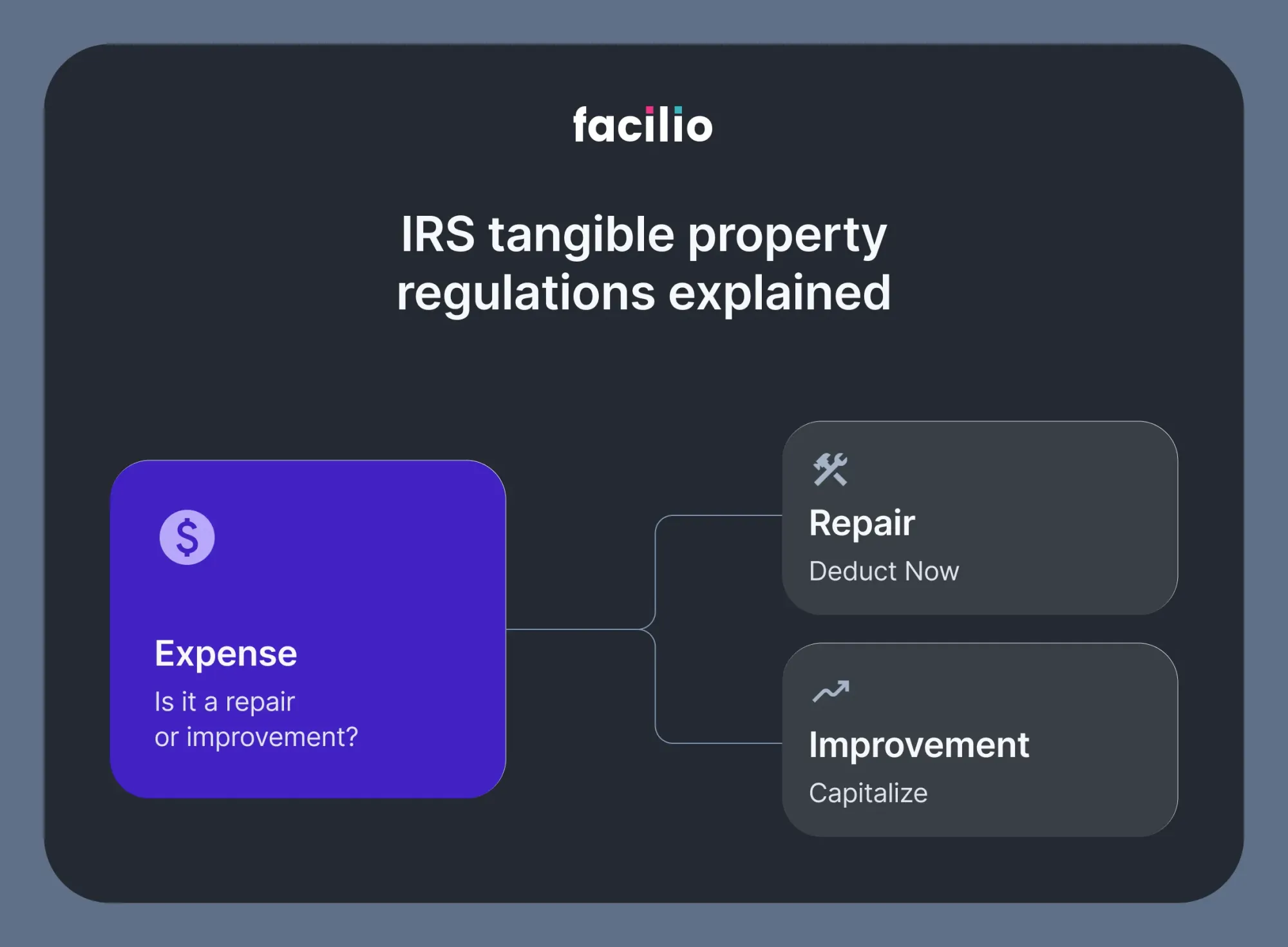

The IRS has clear regulations on whether work is considered a repair that can be deducted immediately or an improvement that must be capitalized and depreciated over time.

The challenge?

These rules are complex, full of gray areas, and easy to misinterpret.

A leaky roof patch may qualify as a repair, but replacing the entire roof could trigger different reporting requirements. Misclassifying expenses not only increases your tax burden but can also expose your organization to audits and penalties.

This guide breaks down the essentials of IRS regulations in plain language, so maintenance teams know exactly what’s at stake and how to navigate the rules confidently.

Why IRS regulations matter for maintenance teams

The IRS tangible property regulations (TPRs) decide how your maintenance expenses are classified. In short, they answer one question:

- Is this a repair you can deduct right away?

- Or is it an improvement that must be capitalized and depreciated over time?

For facility managers, this distinction has a direct impact on budgets. Take HVAC as an example:

- Replacing filters = deductible repair

- Replacing the entire HVAC system = capital improvement

Both jobs are part of building upkeep, but the IRS treats them very differently.

Here’s the catch: maintenance managers aren’t accountants. Yet you’re the ones documenting what gets fixed, what gets replaced, and how much it costs. If that documentation isn’t crystal clear, the finance team may misclassify expenses. That means:

- Higher tax liabilities

- Increased audit risk

- More back-and-forth between maintenance and finance

This is where technology makes life easier.

With Facilio, work orders, costs, and asset histories are all captured in one place.

Instead of chasing down records across multiple systems, finance teams get clean, audit-ready data. And maintenance managers don’t have to play accountant, just keep doing the work while Facilio keeps track of the details. But we will come to this part later.

Repairs vs. Improvements: How to get it right

One of the biggest challenges in IRS compliance for maintenance teams is deciding whether work counts as a repair or an improvement.

To help, the IRS uses the “RABI” test, which looks at whether the work results in:

- Restoration – bringing property back to like-new condition

- Adaptation – changing property to a new or different use

- Betterment – correcting a defect or significantly increasing value

- Improvement – extending the useful life or upgrading the quality of property

If a project falls into any of these categories, it’s generally considered an improvement that must be capitalized.

For example:

- Repair: patching a section of a leaking roof or swapping out worn HVAC belts

- Improvement: replacing the entire roof or upgrading the HVAC system to a higher-capacity model

The problem is, not every situation is clear-cut. A job might look like a repair to the maintenance team but meet IRS criteria for an improvement. These gray areas create confusion, misclassification risks, and headaches if an audit occurs.

This is where accurate, consistent documentation becomes critical.

Detailed work orders, timestamps, and cost records give finance teams the evidence they need to classify expenses correctly. Modern platforms like Facilio support this process by automatically tying maintenance activities and invoices to assets, creating a transparent record that reduces guesswork when applying IRS rules.

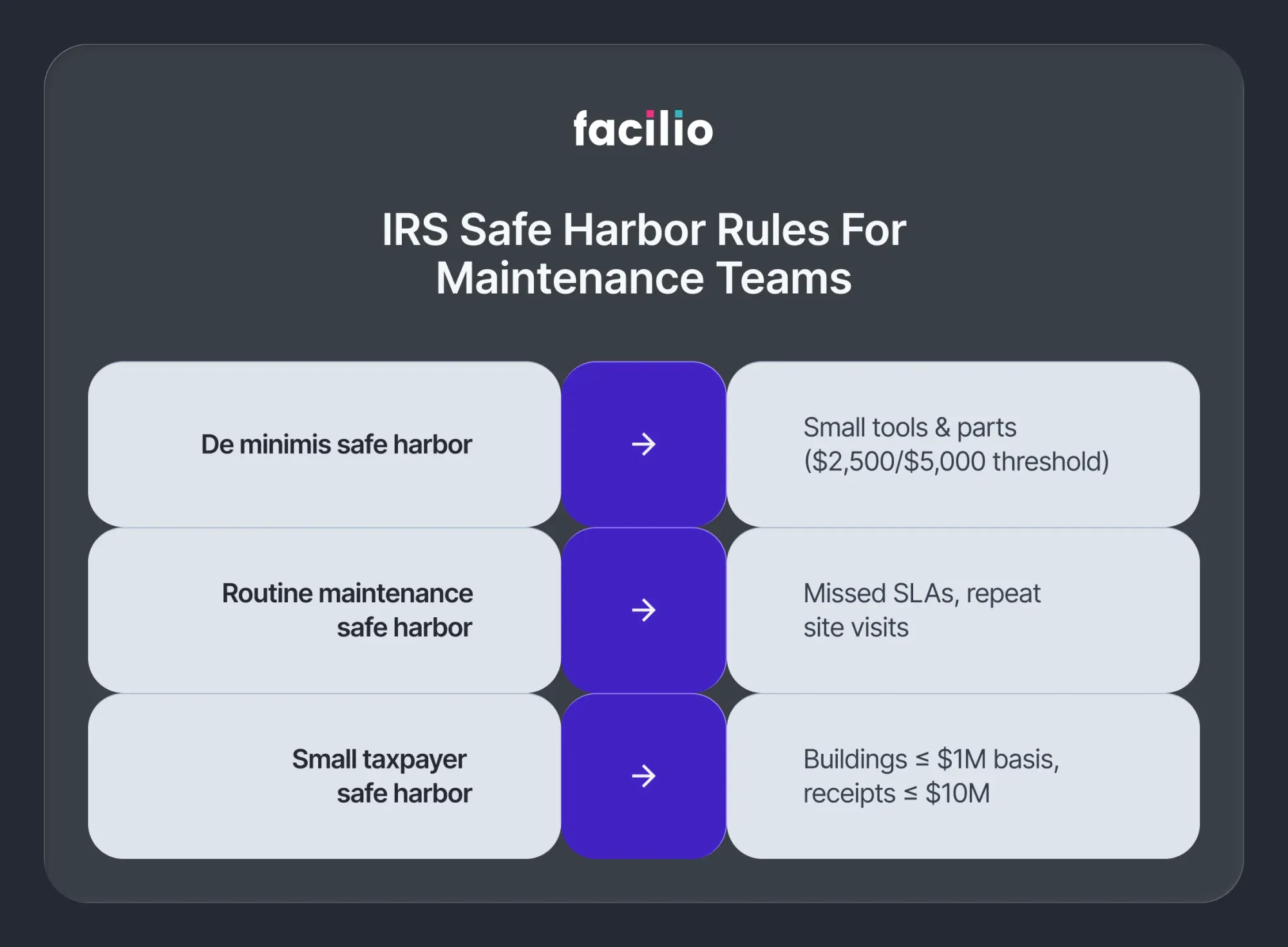

4. Making sense of IRS safe harbors (without the tax jargon)

The IRS created several “safe harbor” rules to make life easier for businesses when classifying maintenance costs. For facility teams, these rules can mean the difference between long, complicated depreciation schedules and immediate deductions.

Let’s break down the three most relevant safe harbors in simple terms.

a. De minimis safe harbor

This rule allows businesses to expense small-dollar purchases right away instead of capitalizing them. The thresholds are:

- Up to $2,500 per item or invoice if you don’t maintain audited financial statements

- Up to $5,000 per item or invoice if you do maintain audited statements

Example: Buying hand tools, replacing light fixtures, or stocking up on spare HVAC parts. These are all routine, low-cost items that qualify under de minimis.

Where teams struggle: Without a centralized record, it’s easy for these smaller purchases to get lost, leaving finance teams unsure whether they meet IRS thresholds. Facilio automatically logs these costs against the right asset or work order, making them easier to track and justify during tax season.

b. Routine maintenance safe harbor

This safe harbor applies when the work is part of regular, predictable upkeep that keeps an asset in normal working condition.

Example: Scheduling elevator inspections, changing HVAC filters, or resurfacing parking lots every few years.

The IRS view: If it’s something you expect to do on a recurring basis as part of normal upkeep, it’s usually deductible.

Where teams struggle: Proving something is “routine” requires showing a history of consistent maintenance. That’s where detailed logs matter. Facilio maintains a clear digital history of recurring tasks, making it easier to demonstrate compliance and back up deductions if questions arise.

c. Small taxpayer safe harbor

This one is designed for businesses with smaller portfolios. You may qualify if:

- Annual gross receipts are $10 million or less, and,

- The building being maintained has a tax basis of $1 million or less

The rule allows you to deduct repairs, maintenance, and even some improvements up to the lesser of $10,000 or 2% of the property’s basis each year.

Example: If you manage a smaller retail property valued at $800,000, you could expense up to $10,000 in repairs annually under this safe harbor.

Where teams struggle: Tracking these caps at the property level can get messy. Facilio makes it easier by generating property-level expense summaries, helping smaller facility teams stay compliant without adding administrative burden.

Repairs vs. improvements: why the difference matters

Not every maintenance expense can be written off immediately. Under IRS rules:

- Capital improvements — like a full roof replacement, major renovations, or energy upgrades — must be capitalized. That means spreading the cost over the asset’s useful life.

- Repairs — such as patching a roof leak, repainting walls, or replacing worn flooring — can usually be deducted right away.

On paper, the distinction seems straightforward. But in practice, it’s rarely that simple. A project that feels like a “repair” to your team may still meet the IRS’s definition of an improvement. These gray areas create real risks:

- Budgets get distorted if expenses are misclassified

- IRS audits become more likely when documentation isn’t clear

That’s why keeping detailed records is critical. Facilio supports this by separating capital projects from routine repairs, and by tying costs and work orders back to individual assets. This gives finance teams the clarity they need to classify expenses correctly — and keeps maintenance teams out of unnecessary audit stress.

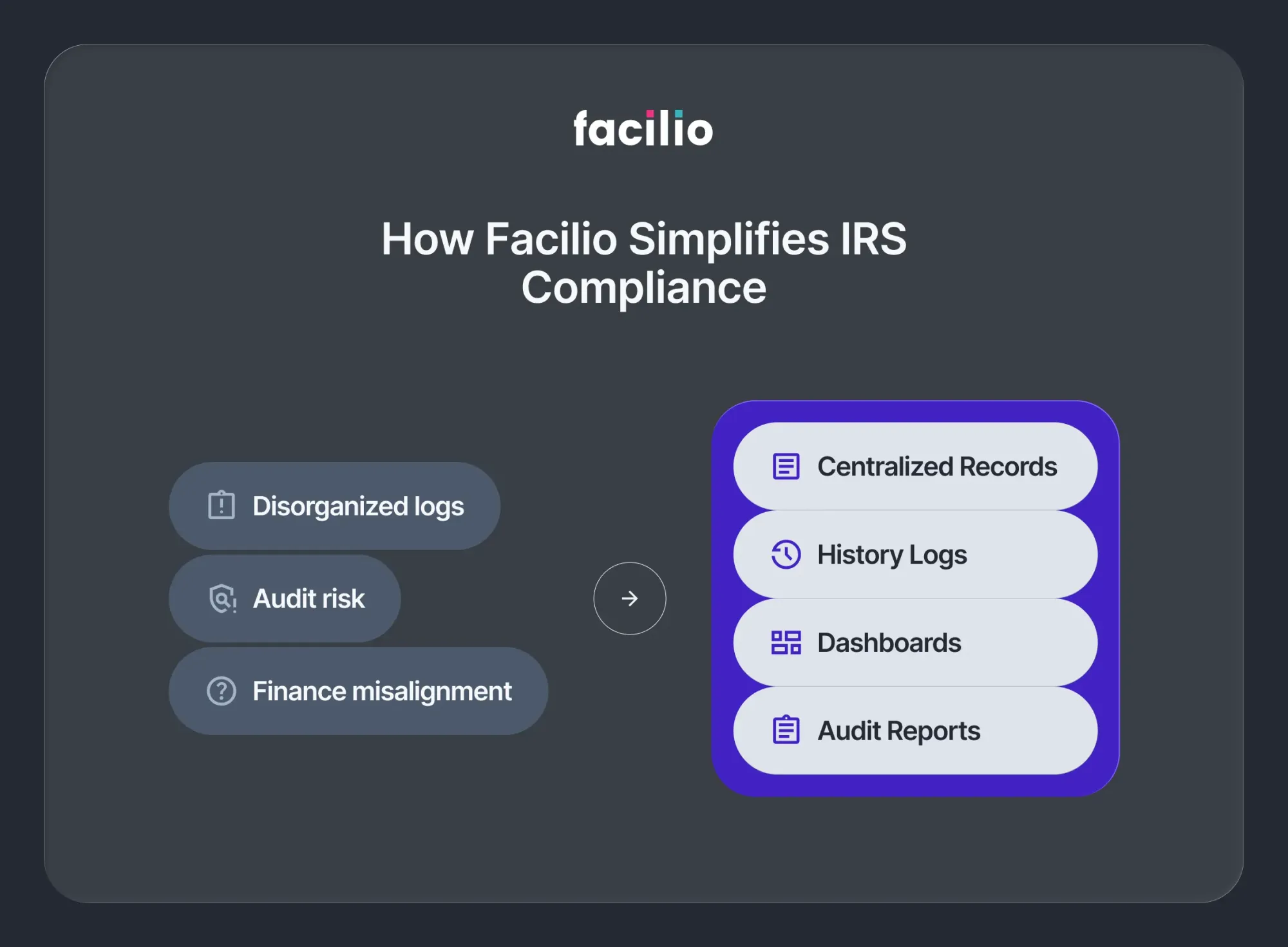

How Facilio simplifies IRS compliance for facility managers

IRS regulations don’t just create challenges for accountants. They affect the way maintenance teams document, classify, and report every job. Here’s where most facility managers run into trouble — and how Facilio's CMMS software helps.

1. Disorganized maintenance logs

- The problem: Work orders and receipts scattered across spreadsheets, emails, and paper files make it nearly impossible to prove compliance during an audit.

- With Facilio: Every repair, expense, and work order is connected directly to assets in a centralized platform, creating a single source of truth.

2. Proving “routine maintenance” vs. capital improvements

- The problem: IRS safe harbors require clear evidence of recurring work. Without a reliable history, it’s hard to justify deductions.

- With Facilio: Detailed maintenance histories are automatically logged, making it simple to support safe harbor elections.

3. Finance and operations misalignment

- The problem: Maintenance teams see repairs, finance teams see expenses — but they don’t always speak the same language.

- With Facilio: Real-time dashboards and reports bridge the gap, giving both sides access to the same clear, accurate data.

4. Audit readiness

- The problem: An IRS audit can stall operations if records aren’t immediately available.

- With Facilio: Compliance-grade reports can be exported in minutes, helping teams respond quickly and confidently.

IRS regulations may seem complex, but getting them right is critical for maintenance teams. Clear documentation and proper classification can mean the difference between smooth audits and costly mistakes.

Facilio helps by keeping every repair, improvement, and expense organized in one place. With audit-ready reports and transparent records, your team can stay compliant, reduce risk, and focus on running operations efficiently.

More from Facilio