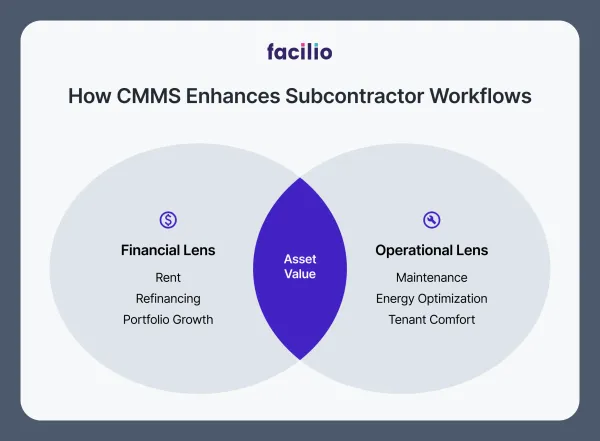

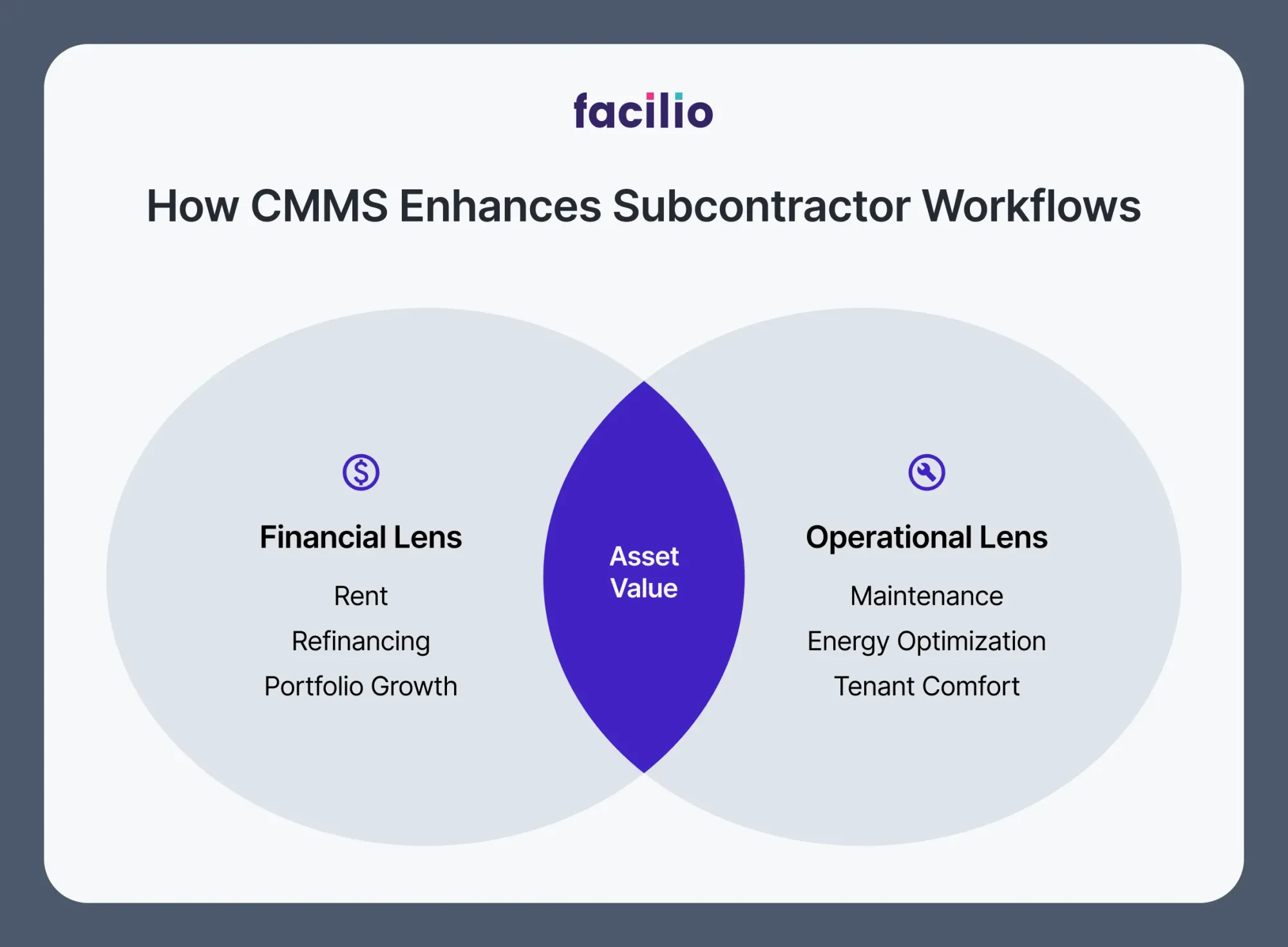

When most people think of real estate asset management, they picture investors making financial decisions to maximize returns. The focus is usually on rent strategies, refinancing, and portfolio planning. But here’s the catch: none of that works without strong operations backing it up.

Industry studies show that up to 37%–50% of a building’s costs are operational — from maintenance and energy use to compliance and tenant services. Inefficiencies in these areas quietly erode asset value.

On the other hand, efficient facilities management directly boosts net operating income, extends asset life, and makes properties more appealing to investors.

That’s why asset management needs a new lens. It’s not just financial strategy; it’s also about operational excellence. Facility and maintenance leaders are central to preserving and growing asset value, and with the right technology, they can turn day-to-day operations into long-term financial wins.

What’s the role of facilities in determining asset value?

Real estate assets don’t just lose value because of market swings; they lose value because of how they’re managed day to day.

For instance, a chiller system that fails five years early, an inefficient energy setup that drives up operating costs, or unplanned downtime that frustrates tenants can all quietly erode the long-term profitability of a property.

That’s where facilities and maintenance leaders come in. Their work has a direct line to financial performance in ways that often go unrecognized:

- Extending asset lifespan: Preventive and predictive maintenance reduce breakdowns, cut replacement costs, and keep buildings performing at their peak for longer.

- Lowering operational costs: Energy optimization, smarter space utilization, and streamlined work order management directly increase net operating income (NOI).

- Data-driven capital planning: When you know the real condition and lifecycle of your equipment, you can plan capital expenses more strategically instead of reacting to sudden failures.

- Improving tenant satisfaction: Comfortable, well-maintained spaces keep tenants happy, reduce churn, and protect rental income.

In other words, facilities are not a cost center; they’re a value driver. The decisions made in maintenance rooms and control centers have a ripple effect that reaches all the way up to the balance sheets of investors.

Why is tech the missing link in asset management?

Traditional asset management tools often focus on financials — spreadsheets, accounting platforms, or portfolio models. They track income and expenses well enough, but they don’t tell you the real story of how a building is performing on the ground. That gap is where technology like CMMS (computerized maintenance management systems) and CAFM (computer-aided facility management software) becomes essential.

These platforms connect the dots between operations and financial strategy by offering:

- Centralized asset data: A single source of truth for asset condition, maintenance history, and lifecycle costs across the portfolio.

- Predictive insights: IoT-enabled monitoring and analytics flag issues before they turn into costly breakdowns, reducing unplanned downtime.

- Portfolio-wide visibility: Cloud-based platforms let you see performance trends across multiple properties, helping you identify patterns and set smarter benchmarks.

- Smarter capital planning: With accurate lifecycle and usage data, teams can prioritize investments and schedule replacements strategically instead of reactively.

- Energy and space optimization: Integrated energy dashboards and space utilization insights tie directly to cost reduction and sustainability goals.

In short, technology transforms facilities from a reactive, cost-driven function into a proactive, data-driven partner in asset management. It enables facility managers to speak the same language as asset managers: ROI, risk reduction, and long-term value creation.

And this is where the conversation shifts. Once the right technology is in place, what tangible outcomes can property owners and portfolio managers actually expect?

Let’s break down the real business results facilities deliver.

How facilities fuel real estate asset management results: 5 keys to success

At the end of the day, asset managers and investors care about results. They want to see stronger returns, lower risks, and properties that hold or grow in value over time.

Facilities and operations directly contribute to these outcomes in measurable ways:

- Reduced operating expenses → higher NOI: Optimized maintenance strategies and energy efficiency initiatives cut recurring costs. Even small percentage reductions in OPEX translate into significant gains in net operating income (NOI), which directly impacts property valuations.

- Extended asset lifecycles → higher valuations: Predictive and preventive maintenance extend the useful life of equipment and building systems. This avoids premature capital expenditures and protects long-term asset value.

- Sustainability and ESG compliance → greater investor appeal: Green certifications, carbon reduction initiatives, and compliance with ESG standards make properties more attractive to institutional investors and tenants who prioritize sustainability.

- Improved tenant satisfaction and retention → stable revenue streams: Comfortable, well-maintained spaces lead to fewer complaints, lower churn, and long-term tenant relationships. For asset managers, this translates into steady rental income and reduced leasing risks.

- Risk reduction → stronger portfolio resilience: Data-driven facilities management minimizes unplanned downtime, compliance failures, and safety incidents. This reduces both operational disruptions and the financial risks tied to them.

Real-world example: Investa

Australian real estate leader Investa turned to Facilio to unify property operations across its commercial portfolio. By digitizing maintenance and centralizing asset data, Investa achieved measurable results:

- Reduced maintenance costs across the portfolio by 20%

- Cut turnaround time for tenant requests by 30%

- Improved energy efficiency benchmarks across buildings

- Strengthened ESG reporting to attract sustainability-focused investors

These improvements not only lowered OPEX but also enhanced tenant satisfaction and positioned Investa’s assets as more valuable, resilient investments in a competitive market.

Investa isn’t alone.

Portfolios worldwide are unlocking asset value through operational excellence.

See how Facilio powers real estate leadersHow Facilio’s Connected CMMS transforms real estate asset management

For years, facilities have been seen as a cost center, a function that keeps buildings running but doesn’t directly contribute to financial growth. That perception is changing.

With Connected CMMS and CAFM software, facilities teams now have the tools to drive measurable value for real estate portfolios.

Here’s how technology transforms asset management goals into outcomes:

- Predictive and preventive maintenance: Anticipate failures before they happen, extend asset life, and avoid unplanned downtime that eats into NOI.

- Energy optimization: Use real-time energy monitoring and analytics to reduce consumption, lower utility bills, and strengthen ESG performance.

- Portfolio-wide visibility: Gain a single pane of glass view into maintenance, energy, and asset condition across multiple properties.

- Capex planning support: Leverage lifecycle data to time equipment replacements strategically and prioritize high-impact investments.

- Cloud + mobile-first collaboration: Enable teams, vendors, and stakeholders to work seamlessly across sites — improving response times and accountability.

Case in point: Kingsmede Australian property group Kingsmede wanted more control over its growing portfolio of commercial properties. Legacy systems left the team with fragmented data and no clear visibility into portfolio-wide performance. By adopting Facilio’s connected CMMS and CAFM, Kingsmede was able to:

- Unify asset and maintenance data across multiple buildings

- Streamline vendor collaboration and service delivery through a single platform

- Improve decision-making with real-time insights into asset condition and performance

- Strengthen operational efficiency, directly supporting long-term asset value

The results?

Kingsmede shifted from a reactive, siloed operations model to a data-driven approach that supports asset management strategy at scale.

Asset management in real estate isn’t only about financial strategy; it’s powered by efficient operations.

With Facilio’s connected CMMS, you can turn facilities into a driver of long-term asset value.

Get started now.

See how Facilio helps you unlock the full potential of your portfolios